International Reserve Management

Management of International Reserves

International reserves are a policy tool available to the Central Bank of Chile (BCCh) to achieve its main objectives: to ensure currency stability and the normal functioning of internal and external payments. In floating exchange rate regimes, such as Chile's, international reserves are used to provide liquidity in foreign currency in order to meet the aforementioned objectives.

The Constitutional Organic Law establishes the legal requirements to be met by the Central Bank in terms of its organization, functions and duties, and generically regulates its powers with regard to the management of international reserves. For this reason, the Board establishes the strategic framework employed in the reserves management process through the approval of an Investment Policy, which is periodically reviewed.

The management of international reserves has changed over the years in relation to the development of financial markets, the introduction of new technologies and the international regulatory framework. Thus, through the mandate and powers conferred by the Constitutional Organic Law, the Board has been developing, in cooperation with the Bank’s management, a set of rules, procedures and practices that seek to ensure the best standards for the management of international reserves.

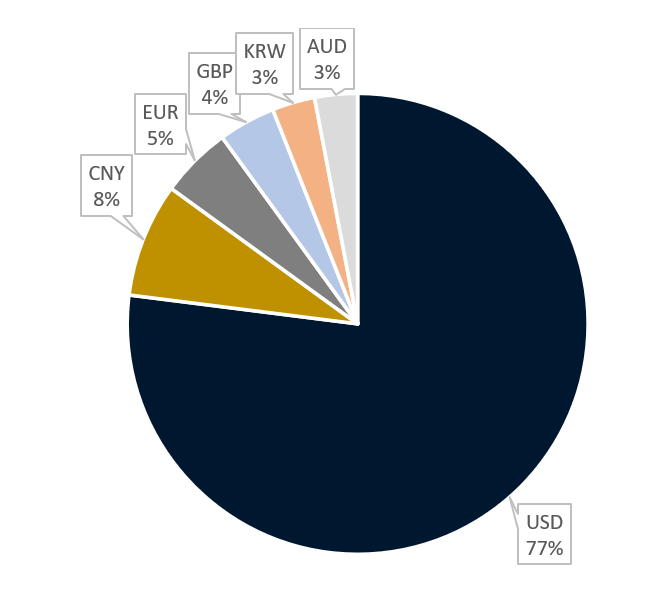

Chart 1: Referencial Composition of Currencies in the Investment Portfolio

For reserves to work as an effective tool for dealing with the situations described in the first paragraph, their absolute and liquidity levels must be adequate. When this is achieved, international reserves may vary according to movements in prices and parities, but these changes will never alter the Bank’s ability to meet its commitments. Thus, the objectives of liquidity and capital preservation constitute two central axes in the formulation of the Bank’s Investment Policy, which enables the Board to assert, with a some degree of certainty, that it will always have at its disposal the amount of resources needed for the implementation of its policies, within a limited period of time and at a reasonable cost.

Portfolio Structure

The current referential structure of the investment portfolio is composed of two portfolios: (a) liquidity (60% of international reserves); and (b) diversification (40%). The international reserves portfolio is made up of the investment portfolio, the cash portfolio (balances held in current account by the Treasury, public companies and banking companies) and other assets (Special Drawing Rights of the International Monetary Fund, certified gold and others).

Chart 2: Evolution of International Reserves

The current referencial structure of the investment portfolio is composed of 100% sovereign debt instruments with an average duration of around 3 years, with 20% of this composed of inflation-indexed instruments. In terms of country participation, 77% is debt issued by the United States, 8% by the People's Republic of China, 5% by countries in the Euro zone, 4% by the United Kingdom, 3% by South Korea and 3% by Australia. The dominant risk rating of the referencial portfolio is AAA.

The management of international reserves includes a program of external administrators, which empowers them to manage a fixed income portfolio of long-term global governance with a structure equivalent to that of the diversification portfolio managed internally. There are currently two external administrators, which manages approximately 3% of the portfolio.

International Reserves and Foreign Currency Liquidity Disclosure

The international reserves and foreign currency liquidity template shows consolidated numbers for the Central Bank of Chile and the Central Government. Therefore, these numbers do not represent the situation of the Central Bank, which is in no way responsible for the payment of the Central Government's committments. This is derived from the Central Bank's legal status as an independent institution.