Payment systems

In this page

-

Large Value Payment Systems

-

Low Value Payment Systems

-

Principles for Financial Market Infrastructures (PFMI)

-

Regulation, Documents and Statistics

-

Procedure for accessing the RTGS System

Payment systems are vital for the proper functioning of modern economies. In particular, they enable the completion of financial transactions, payments for goods and services of the real sector, and the implementation of the monetary policy of the Central Bank of Chile. According to its international definition, a payment system comprises a series of instruments, procedures and regulations for the transfer of funds between two or more participants, and is composed by the system operator and its participants.

The Constitutional Organic Law establishes as one of the mandates of the Central Bank of Chile to ensure the normal functioning of payments. The Central Bank fulfills this mandate by regulating payment systems and by operating the Real-Time Gross Settlement System. In both roles, its objectives are to increase the security and efficiency of payment systems, considering the application of the minimum standards and requirements suggested by international organizations concerning this matter.

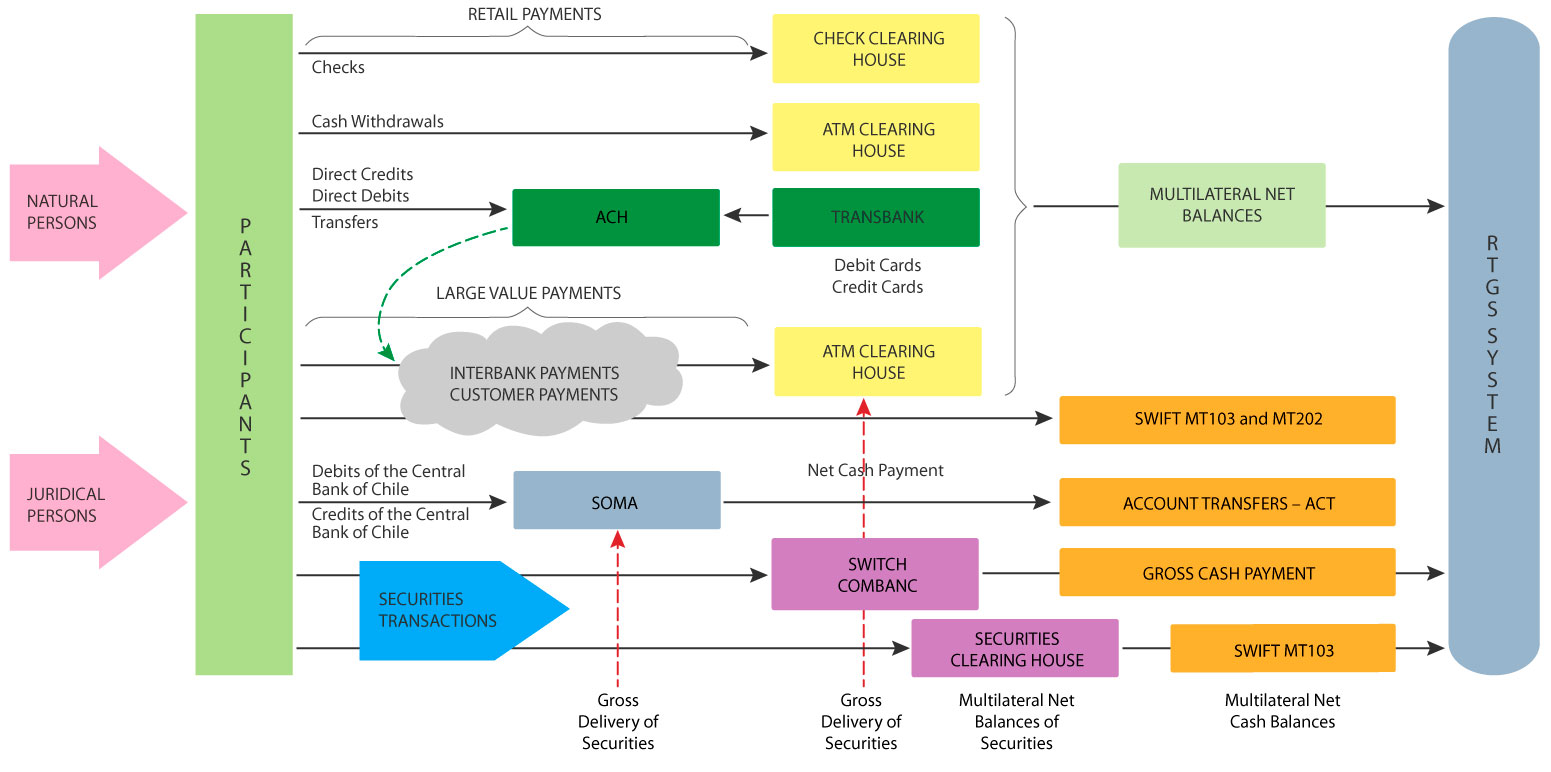

Relations between the Main Players of the Payment System in Chile (Table)