Bank functions

Bank duties

One of the objectives that Article No. 3 of the Organic Law entrusts to the Central Bank of Chile is to ensure the stability of the currency, that is, to keep inflation low and stable over time.

The Bank should also foster the stability and efficiency of the financial system, ensuring the normal functioning of internal and external payments.

These objectives help or enable the creation of a predictable environment for decision-making, thereby contributing to smoothing economic cycles and laying the foundations for the country’s sustained growth.

In order to meet its objectives, the Bank —among other duties— ought to regulate the amount of money in circulation and credit in the economy, so that they are sufficient for individuals, companies and institutions to carry out their transactions.

Inflation Control

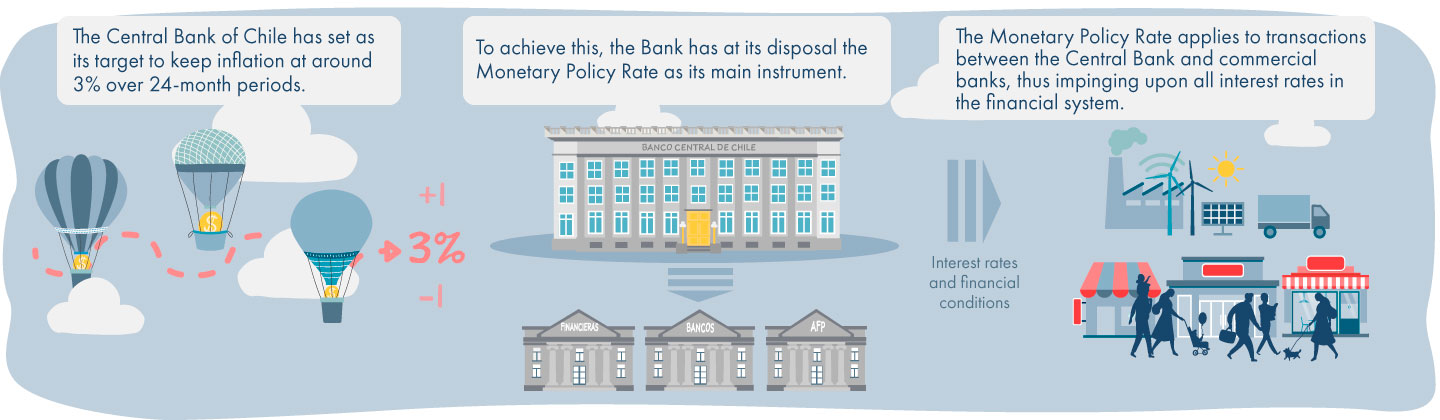

The operating objective of monetary policy is to keep annual inflation projections at around 3% annually over a horizon of about two years.

The main instrument available to the Central Bank of Chile to keep inflation aligned with this target is the so-called Monetary Policy Rate, which is determined at each Monetary Policy Meeting.

Through different operations, the Bank influences the interest rate of daily interbank loans, so that it be located around the Monetary Policy Rate. This in turn impinges upon the demand and supply of money, all of which has an effect —with some delays— upon the prices in the economy.

During the year, eight Monetary Policy Meetings take place, at which the Monetary Policy Rate is decided, and four Monetary Policy Reports are published, which contain an exhaustive analysis of the national and international macroeconomic scenario, as well as growth and inflation forecasts.