Monetary Policy

Money plays a fundamental role in the proper functioning of any economy. To safeguard this role, the monetary policy of the Central Bank of Chile must protect the value of the national currency, the peso, aiming at keeping inflation stable and low.

The Central Bank of Chile structures its monetary policy employing a conceptual framework of inflation targets, which is complemented by a floating exchange rate regime. This entails the commitment to use the appropriate instruments to ensure that annual CPI inflation remains most of the time around 3%.

This commitment directs the expectations of economic agents and transforms the center of the goal into the nominal anchor of the economy.

4,5

MPR

3%

Target

CPI

0,4

Monthly

2,8

Annually

CPI W/O VOLATILES sin (change, %)

0,7

Monthly

3,4

Annually

Latest Monetary Policy Meetings (MPM)

Latest Monetary Policy Reports (MP Report)

Relevant information

What is inflation?

Inflation is the sustained and generalized rise in prices in an economy. When inflation is high and unstable, it affects people's welfare in many ways. In the first place, it erodes the purchasing power of money, i.e., the same amount of money will be able to buy fewer goods and services. But it also generates greater uncertainty, affecting agents' decisions. For example, people could anticipate purchases for fear that prices will continue to rise, or companies could postpone their investments in the face of an unstable outlook.

What is the inflation-targeting scheme?

The Central Bank conducts its monetary policy based on an inflation-targeting and floating exchange rate scheme. This scheme incorporates the Central Bank's explicit commitment to use the instruments granted to it by the Law so that, regardless of the current level of inflation, the projected inflation over a two-year horizon is 3%. The commitment to this target helps to guide the expectations of economic agents and provides a clear and unique reference for the evolution of prices.

Why the 3% target?

An inflation rate permanently above this mark would hardly be considered a reflection of price stability and would bring the country closer to an inflationary level that could undermine economic growth and the welfare of the population.

On the other hand, inflation below 3% is costly mainly because of three factors:

I. It could increase the loss of output and employment in the face of negative shocks to activity, due to the downward rigidities that price levels and adjustments tend to show.

II. In any country, it is possible that the price indexes used, such as the CPI, overestimate real consumer inflation.

III. Since there is a minimum value for the nominal interest rate, monetary policy loses room for maneuver when inflation is close to or below 0%, limiting the floor to which the real interest rate (i.e., the difference between the nominal interest rate and inflation expectations) can fall.

How is inflation measured?

Inflation is measured through the variation of the Consumer Price Index (CPI) prepared by the National Statistics Institute (INE). This is the most widely used price index in the country and measures the monthly variation of prices of a basket of goods and services representative of household consumption. However, it contains a number of items with highly variable prices, such as some foods (which rise and fall according to seasonality and other temporary phenomena) and goods and services linked to the price of oil (subject to volatility in international markets). For this reason, the Central Bank prepares core inflation indicators (CPI without volatility), which excludes the most volatile items in the basket that are more closely related to the medium-term inflationary trend.

What is the meaning of a floating exchange rate?

The inflation-targeting scheme is complemented with a floating exchange rate regime, meaning that the exchange rate is determined by the market, according to the supply and demand of foreign currency. In a context of free capital mobility, this regime is fundamental for the execution of an independent monetary policy, that is, the ability to have a monetary policy orientation different from that of other countries with larger financial markets. The Central Bank reserves the right to intervene on exceptional occasions in the foreign exchange (forex) market.

What is monetary policy?

One of the objectives that the Organic Constitutional Law stipulates for the Central Bank is "to safeguard the stability of the currency." In practice, this means that the Bank must prevent the value of the currency from deteriorating due to inflation. Thus, it is understood as a price stability objective. All the actions combined that the Central Bank adopts to meet this objective are known as Monetary Policy.

What is the monetary policy interest rate (MPR)?

The MPR is the main operational instrument of monetary policy. In practice, it is the interest rate at which the Central Bank lends to commercial banks, but it also affects all rates in the financial system. The MPR is determined by the Central Bank's Board at the monetary policy meetings, which are held eight times a year. There the Board decides on a level for the MPR and communicates the trajectory that will achieve compliance with the inflation target.

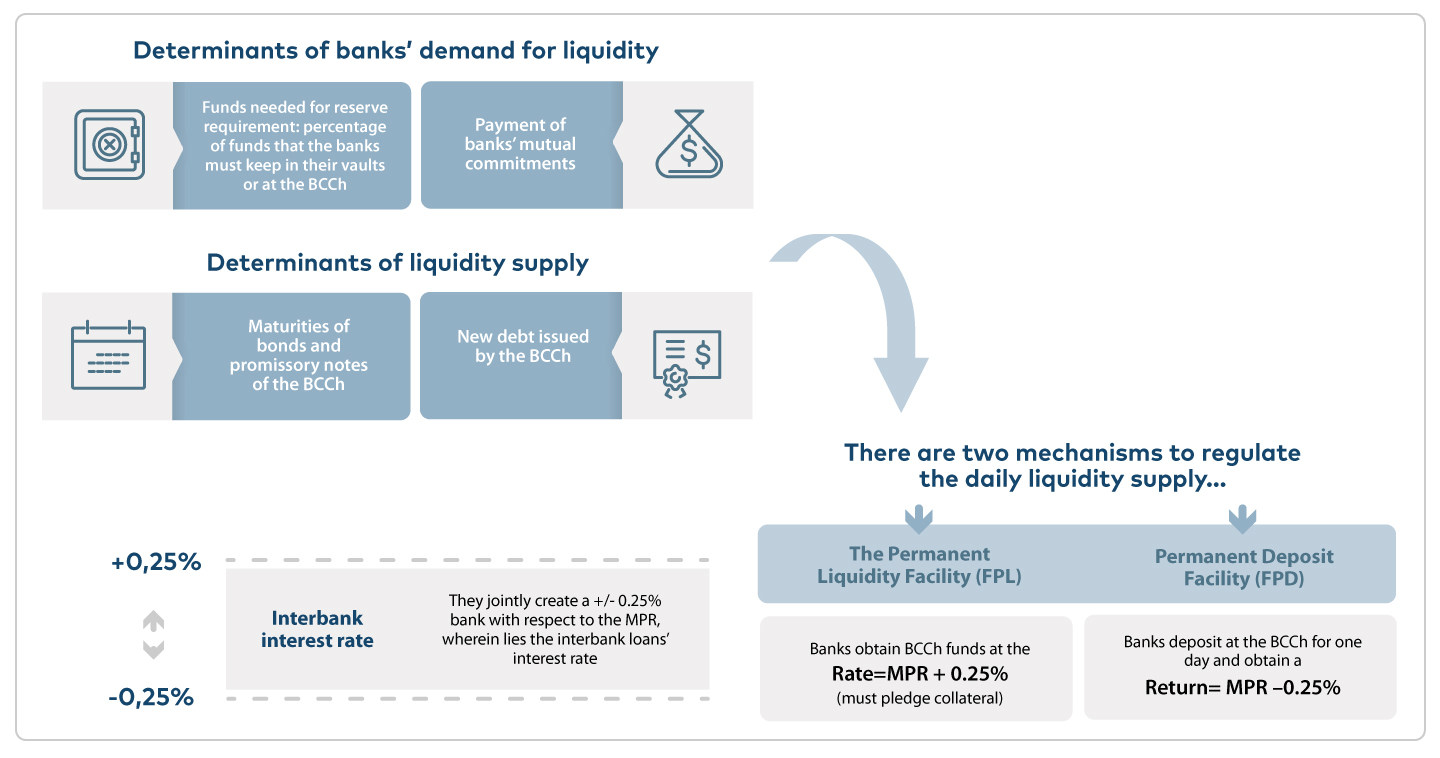

What is the interbank rate and how does it relate with the MPR?

The Central Bank conducts its monetary policy by influencing the interest rate at which banks lend to each other from one day to the next (known as the overnight interbank interest rate). This rate is determined by the equilibrium between supply of and demand for funds. In practice, the Central Bank controls the supply of liquidity —or monetary base, which corresponds to the banknotes and coins issued by the Central Bank and the deposits held by commercial banks at the Central Bank— so that the resulting interbank rate is close to the monetary policy rate (MPR). Thus, the MPR corresponds to the target interbank rate that the Central Bank seeks to achieve.

How does monetary policy operate?

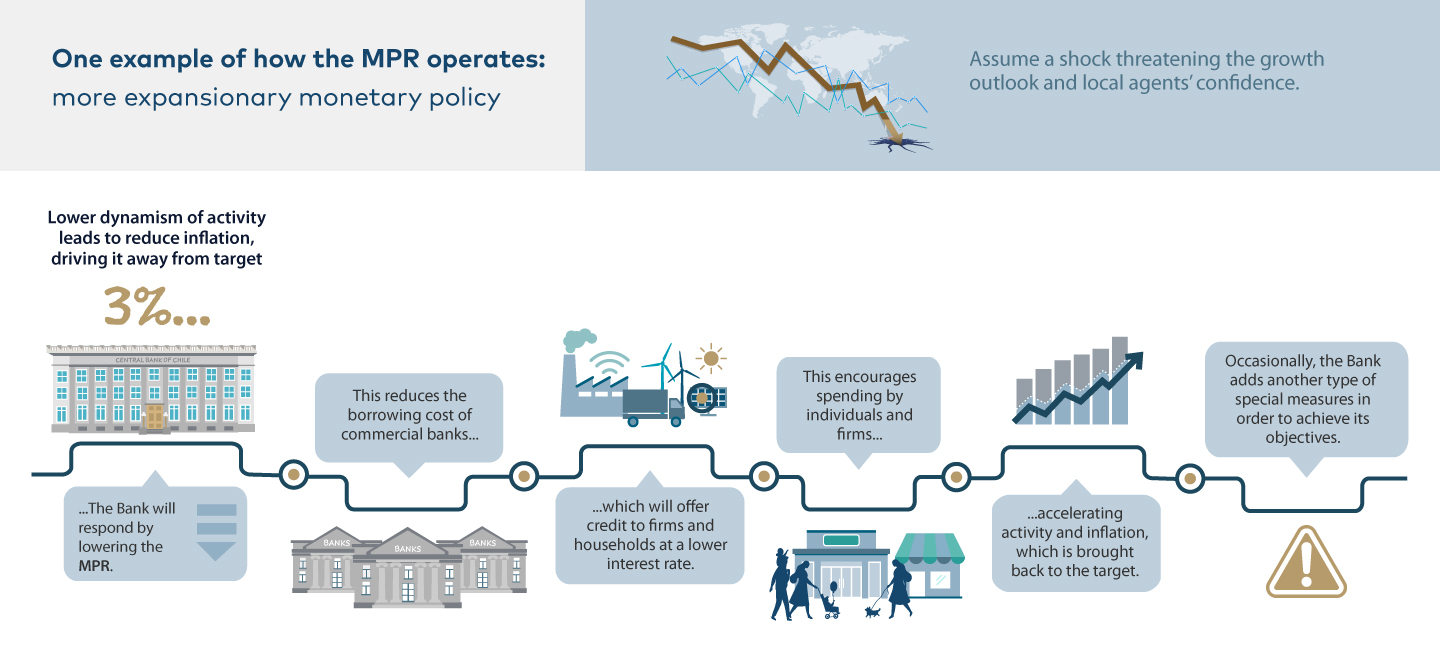

In practice, a change in the monetary policy rate modifies the cost of borrowing for commercial banks and, through them, for individuals and companies. This leads to changes in consumption and investment decisions, which in turn affect economic activity and inflation.

Why the two-year horizon?

The two-year horizon accommodates the lags between changes in the monetary policy rate (MPR) and their effects on activity and prices. At the same time, it reduces the volatility of output, limiting the effects of transitory inflation variations.

What are non-conventional measures?

Unconventional measures are a set of special instruments used by the Central Bank to achieve its objectives. They have been used in periods such as the Global Financial Crisis or, since the end of 2019, to address the impact of internal and external shocks to which our economy has been exposed. In the first episode, the use of Term Liquidity Facilities (FLAP) stood out as a way of committing to keep the MPR at its lower limit for an extended period of time. In the second one, the Central Bank introduced a set of measures, including the three stages of the Financing Facility Conditional on Increased Lending (FCIC), liquidity measures in pesos and dollars, and foreign exchange interventions.

The Board of the Central Bank of Chile

The highest authority of the Central Bank of Chile is its Board, which governs and administers it and makes decisions on conventional and non-conventional monetary policy. Likewise, the Board adopts other financial and forex regulation decisions.

All these decisions are aimed at achieving the Bank's objectives: to ensure price stability and the normal functioning of internal and external payments.

The Board is made up of five members, appointed by the President of the Republic, upon prior approval by the Senate. Each member serves for ten years. At the same time, one of them serves as the Governor for a term of five years.

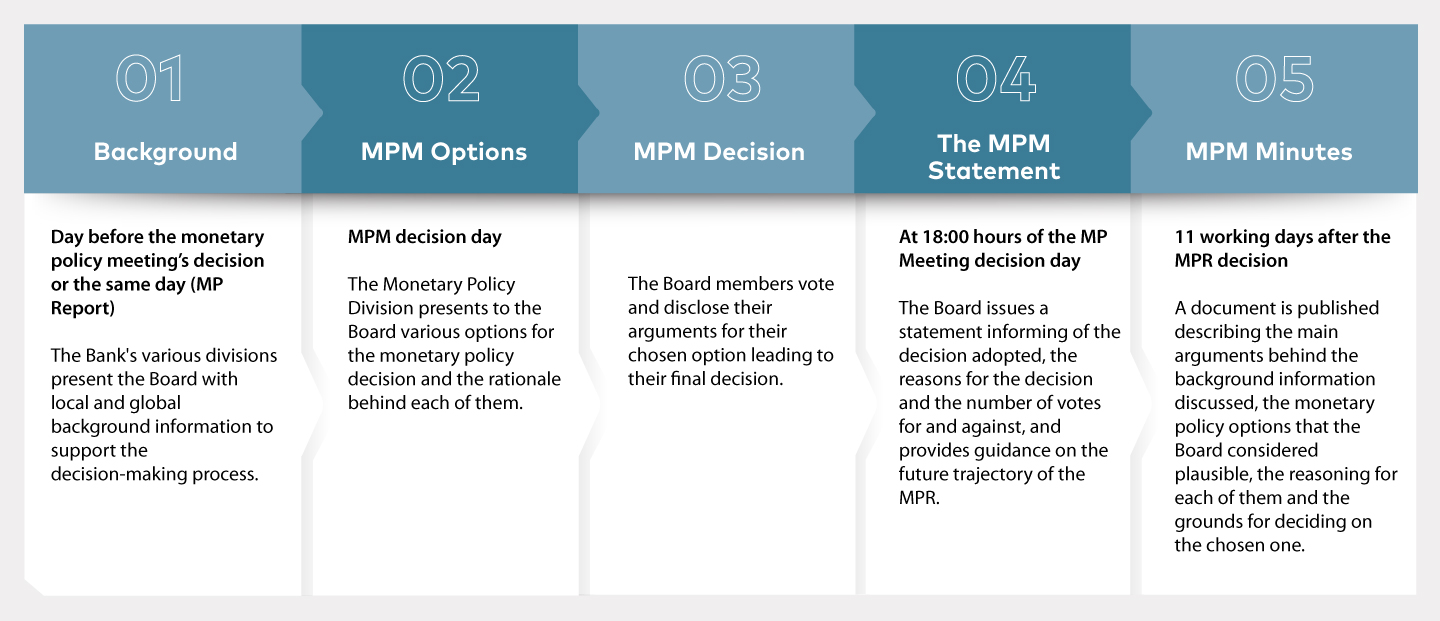

Monetary policy meetings

The Monetary Policy Meeting (MPM) is the decision-making instance in which the Board of the Central Bank of Chile decides on changes to the Monetary Policy Rate (MPR). In 2018, the number of annual meetings was reduced to eight (from 12 previously). Bank managers and analysts also participate in the MPM, along with a representative of the Ministry of Finance, all of them without voting rights.

Four of these meetings are held on the business day prior to the publication of the Monetary Policy Report and they take place on one day. On the other four occasions, the meeting lasts one and a half days.

Each September, the calendar for the next year's meetings is announced, together with the dates of publication of the year's Monetary Policy Reports.

Transcripts of past monetary policy sessions

In accordance with its policy of institutional transparency, the Bank makes the transcripts of past monetary policy sessions available to the public after ten years have elapsed since the date of each such session and on the basis of an annual disclosure criterion, in March of each year.

The content of the published transcripts is fully disclosed, except for those passages or elements that must remain secret or reserved pursuant to the provisions of articles 65 bis and 66 of the Constitutional Organic Law governing the Central Bank, in connection with the relevant provisions of Law No. 20,285 on Access to Public Information.

- View historical MP Meeting documentation

What is the MP Report?

The Monetary Policy Report is an official document of the Central Bank's Board whose main purposes are: (i) To inform and explain to the Senate, the Government, and the general public its view on the recent and expected evolution of inflation and its implications for the conduct of monetary policy; (ii) To publicly expose the medium-term framework of analysis used by the Board in formulating monetary policy; and (iii) To provide useful information for the formulation of economic agents' expectations about the future path of inflation and output. The MP Report also responds to an obligation set forth in the Constitutional Organic Law of the Central Bank to inform the Senate and the Minister of Finance (Art. 80).

Chapter I of the MP Report analyzes the main factors that explain the recent evolution of the macroeconomic scenario at the national and international levels. These include the external environment, financial conditions, aggregate demand and activity, and recent price and cost developments.

In addition, a section (Chapter II) presents the considerations behind the monetary policy strategy for the coming quarters and describes how the monetary policy reaction to certain revisions to the central scenario could change. These scenarios are the so-called sensitivity scenarios, which imply situations where the economy would behave within the ranges forecast in the growth projection, but the achievement of the inflation target would require a different monetary policy path. The MP Report also discusses more extreme scenarios, the so-called risk scenarios. In these, the economy would drift out of the growth range and monetary policy would undoubtedly be different

Frequency

The MP Report is published four times a year. It is released first thing in the morning of the working day following the Monetary Policy Meeting (MPM) in March, June, September, and December, containing relevant information explaining the monetary policy decision adopted.

Who produces the MP Report?

The MP Report is prepared mainly by the Monetary Policy Division (MPD), with the support of other divisions. The MPD has four departments: the International Analysis Department builds the Report's baseline scenario for the international economy, making short and medium-term projections and alternative scenarios. The Macroeconomic Analysis Department advises on the preparation of the Report by preparing the baseline scenario, together with the sensitivity and risk scenarios for the national economy. The Economic Studies Department advises on the research of economic matters of conjunctural relevance, which can be published in the boxes contained in the MP Report. Finally, the Monetary Policy Strategy and Communication Department responsibility is to reflect the Board's vision and the analysis of the rest of the departments in the drafting of the Report. In total, around 40 professionals work directly in the production of the MP Report, but there are many more considering those who contribute in a more indirect way, from those in charge of obtaining raw data to workers from other divisions who support the analysis of specific topics.

Who is the target audience?

The MP Report is aimed at the specialized public (market players and analysts), the general public and public entities such as the Senate and the Government. For this reason, the publication of the MP Report is complemented by a set of information aimed at different audiences, with the objective of improving their understanding of the Board's decisions and the future orientation of monetary policy. Thus, for the specialist audience, the Report is complemented with minutes on internally conducted research, files that gather historical information on projections and technical presentations by the Board and Bank staff members. For the general public, the MP Report is complemented with infographics that summarize the contents of the Report in a more user-friendly way, presentations that cover the main topics included in the Report, with questions and answers to address the main topics in the MP Report, and a video that presents the Report's information in simplified form. In addition, the Board and staff members make presentations so that all audiences can access these contents from the original source.