Acordeones: Medidas Excepcionales

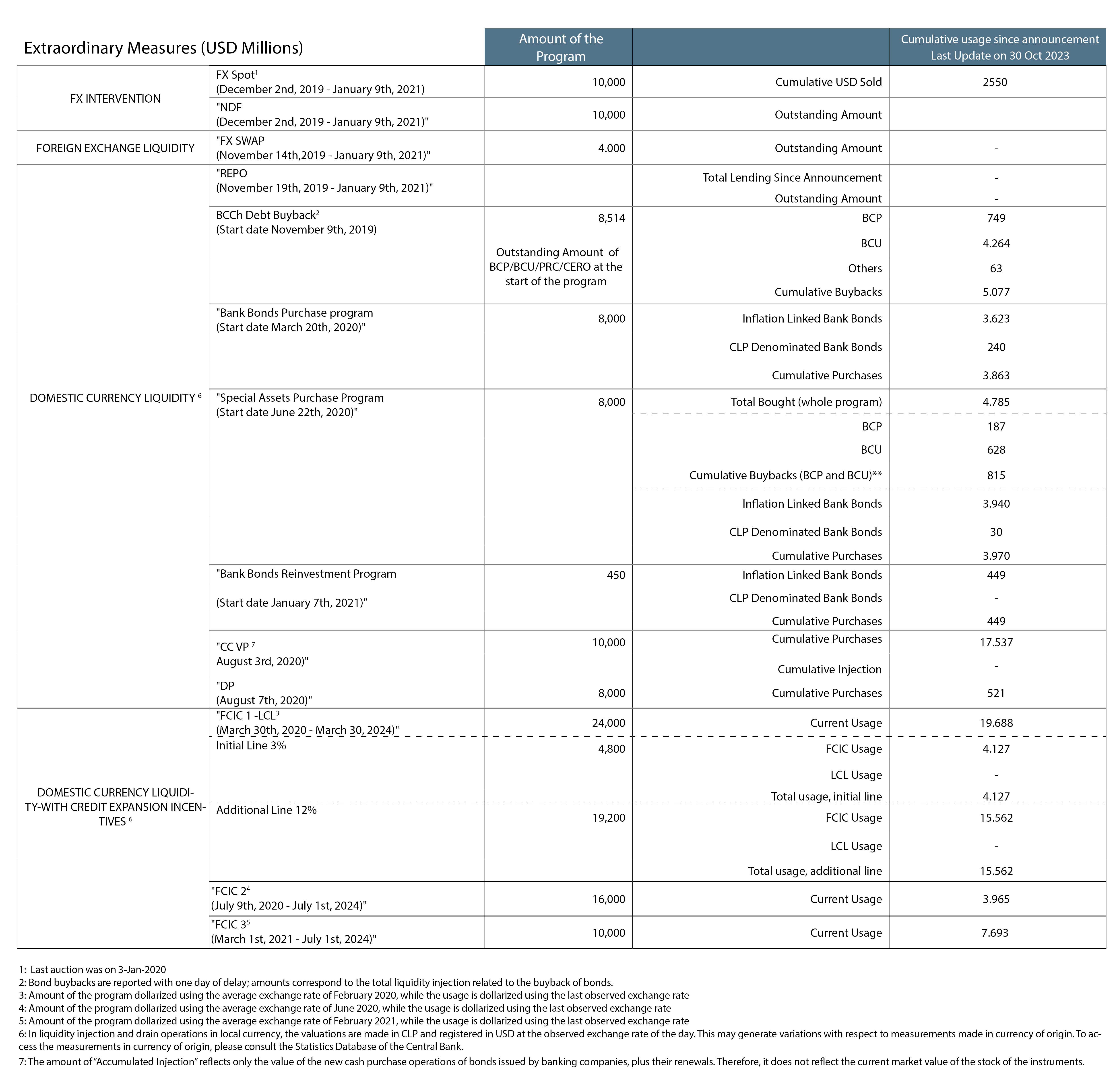

Measures summary table

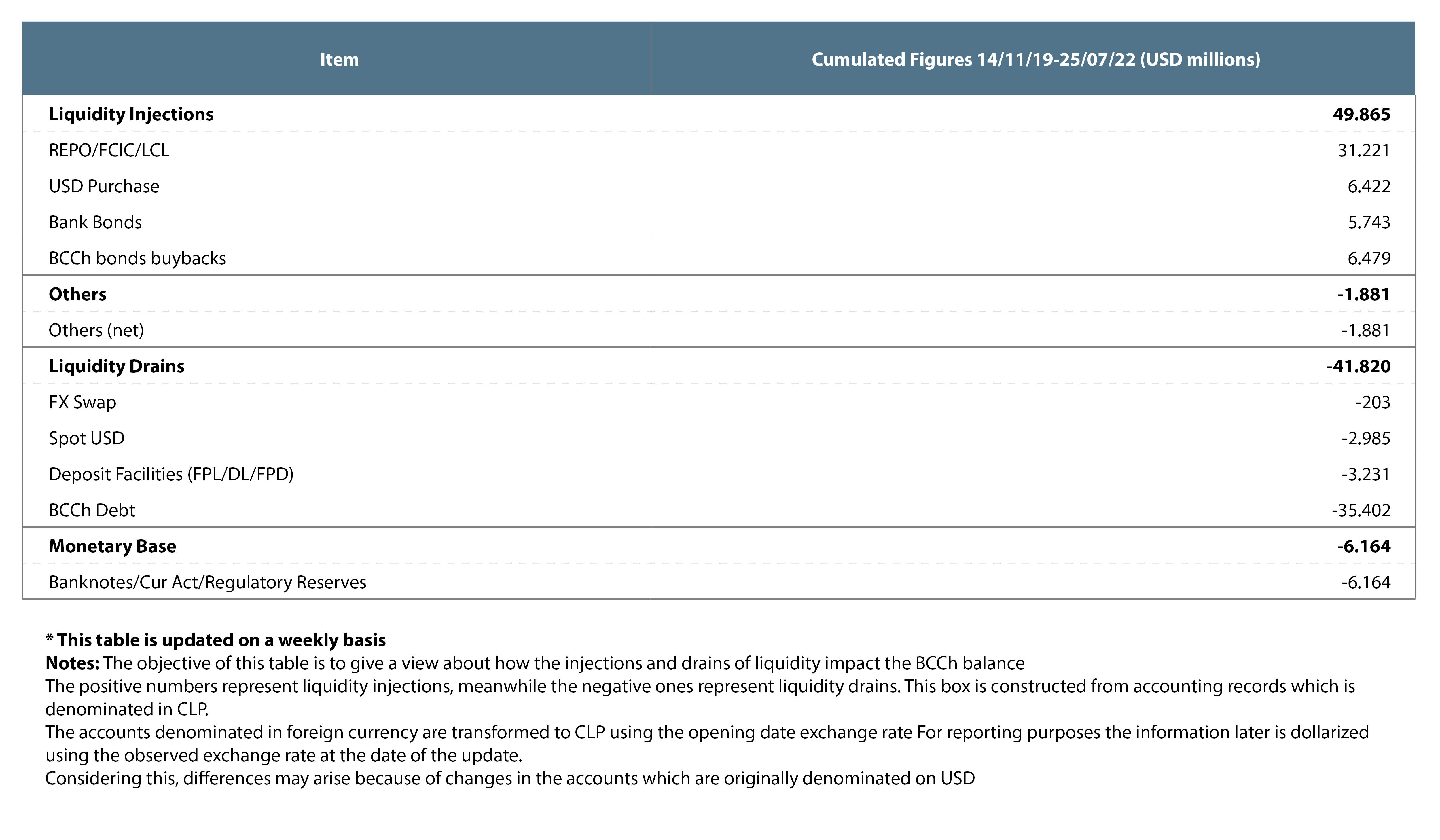

Injections and drains of liquidity

1. Liquidity injections and FX market

Since November 2019, the Central Bank of Chile (CBC) has implemented a preemptive program which has the objective of facilitating liquidity within the local financial system both in domestic and foreign currency. Concurrently, the CBC implemented an FX intervention program to diminish excess volatility of the exchange rate. Additionally during this period, the CBC has carried out measures which have the objective of increasing the effectiveness operations announced in domestic and foreign currency, and to facilitate the liquidity management of the local financial system.

-

On November 13, 2019, the CBC announced a REPO and FX Swap program to increase the liquidity of the local markets in domestic and foreign currency.

-

On November 14, 2019, the Central Bank allowed the use of bank bonds as collaterals in all liquidity operations denominated in Chilean pesos.

-

On that same day, a debt buyback program was implemented to increase the liquidity of non-banking agents, such as mutual funds, insurance companies, pension funds, as well as the liquidity of the banks. The CBC also temporally suspended the issuance of short-term securities (PDBC), as a strategy to support the liquidity of the financial system.

-

From November 28, 2019 to May 29, 2020, the CBC implemented an FX intervention program aimed to sell USD for up to US$ 20 billion; according to the following scheme:

- Sale of USD on the spot market for maximum total of US$10 billion, of which US$ 2.5 billion have been sold.

- Sale of USD on the forward market for hedging purposes for up to US$10 billion

-

On January 3, 2020, the CBC announced that it would roll-over only the outstanding FX forward stock, which rose to US$ 4.5 billion

-

From March 16, 2020, and initially until January 9, 2021, the CBC extended the REPO and FX Swap programs due to worsening financial conditions in international markets. This resulted in the following:

- The inclusion of new maturities in REPO operations: 7 and 180 day maturities were added to the existing 30 and 90 day maturities.

- The inclusion of new maturities in FX Swap operations: 90 and 180 day maturities were added to the existing 30 day maturities.

- In both cases, the operations with 180 day maturities were available until the first week of July, 2020.

-

On March 18, 2020, a temporary change to the reserve requirement regulations for Banks and other credit supplying companies was introduced, extending from March 9, 2020 until September 8, 2020. This has allowed these institutions to complete their reserves with foreign currency deposits, USD, euros and Japanese yen, and local currency.

-

Additionally, the amount of dollars offered daily by the FX Swap program was increased to US$ 400 million in the 30 day bucket, for the 19th and 20th of March, 2020.

NDF

REPO

FX SWAP

Cental Bank Debt Stock

Tradable Monetary Liabilities

Debt Buyback Program

Program CC VP

Program DP

Press Releases

- Comunicado miércoles, 13 de noviembre de 2019, sobre: El Banco Central de Chile informa medidas para facilitar la gestión de liquidez del sistema financiero

- Comunicado jueves, 14 de noviembre de 2019, sobre: Banco Central de Chile amplía medidas para la gestión de liquidez del sistema financiero

- Comunicado martes, 19 de noviembre de 2019, sobre: Banco Central de Chile ajusta programa de gestión de liquidez del sistema financiero

- Comunicado viernes, 13 de diciembre de 2019, sobre: Calendario de intervención cambiaria del 16 al 20 de diciembre de 2019

- Comunicado viernes, 20 de diciembre de 2019, sobre: Calendario de intervención cambiaria del 23 de diciembre de 2019 al 3 de enero de 2020

- Comunicado jueves, 12 de marzo de 2020, sobre: El Banco Central de Chile informa la ampliación del programa de gestión de liquidez en dólares y pesos vigente

- Comunicado miércoles, 18 de marzo de 2020, sobre: Banco Central modifica transitoriamente normas de encaje monetario y aumenta provisión diaria de dólares del programa FX Swap

2. Monetary policy rate and loans to the banking sector

The CBC expanded monetary stimulus by cutting the monetary policy rate (MPR) to its technical minimum, and by adopting a set of extraordinary measures:

-

On March 20, 2020, the CBC cut the MPR by 75 bps, reducing the rate to 1%, and implemented the following measures:

- Opening the Conditional Financing Facility for Increased Loans (FCIC) and activating of the Liquidity Credit Line (LCL) for commercial banks. This credit line is conditional to increased lending to consumers and businesses (particularly small and medium sized businesses).

- The inclusion of corporate bonds as eligible collateral for liquidity operations conducted by the CBC.

- Implementation of a bank bonds purchase program for all participants of the SOMA system (banks and others financial institutions), for an equivalent of US$ 4 billion and with a remaining maturity up to 5 years

- Extension to January 9, 2021 of the FX intervention program implemented during November 2019.

-

On March 31, 2020, the CBC cut the MPR by 50 bps, reducing it to its historical minimum of 0,5%

-

On the same date, the CBC increased the banks bonds purchase program by an additional US$ 4 billion, reaching US$ 8 billion, and lifted the maturity restriction. With this change, the remaining amount in the program was US$5.5 billion (US$3.5 billion had already been purchased).

Press Releases

- Comunicado martes, 26 de noviembre de 2019, sobre: Banco Central de Chile adelanta fecha de la Reunión de Política Monetaria (RPM) y de publicación del IPOM de diciembre de 2019

- Comunicado jueves, 5 de diciembre de 2019, sobre: Banco Central publicó Informe de Política Monetaria (IPoM) de diciembre de 2019

- Comunicado lunes, 16 de marzo de 2020, sobre: La rápida propagación del COVID-19, junto con las medidas sanitarias adoptadas en diversos países

- Comunicado miércoles, 1 de abril de 2020, sobre: Banco Central publicó Informe de Política Monetaria (IPoM) de marzo de 2020

3. Credit line facilities (FCIC/LCL) and other financial measures

The Central Bank of Chile (CBC) established a new credit line facility for commercial banks, access to which is conditional on the growth of credit issuance. The main purpose of this facility, named FCIC, is to encourage banks to continue to finance households and firms, particularly small and medium-sized enterprises that do not have access to capital markets.

This report summarizes the information collected from banks on the use of the resources granted by this facility. Through this, the CBC informs the public of how this policy had been implemented.

The Conditional Financing Facility for Increased Loans (FCIC) and the Liquidity Credit Line Facility (LCL) were measures established by the Central Bank of Chile (CBC) to cope with the impact of internal and external shocks to the Chilean economy. These credit facilities made resources available to commercial banks, such that banks would maintain financing and refinancing loans to households and companies, especially small and medium-sized enterprises (SME) that do not have access to capital markets.

On March 26, 2020, the CBC established the operational rules for FCIC and LCL, along with temporarily relaxing its regulation on banking liquidity management. The characteristics of the FCIC are:

-

It is a line open to all commercial banks that operate locally and issue commercial or consumer loans.

-

It begins with the initial line of credit, which corresponds to 3% of the commercial portfolio plus the consumer loan portfolio (base portfolio) at the end of February 2020.

-

It includes an additional line that depends on the dynamics and composition of the credit issuance of each entity, with an additional limit of 12% of the base portfolio.

-

The funds are withdrawn through an operation similar to a REPO, which requires them to be supported by eligible collateral. The term of the facility is 4 years.

-

Additionally, it is possible to access to the resources using the LCL, with a limit of the average reserve requirement in local currency.

On April 16, 2020 the additional line of the FCIC granted to banks was activated. The size of this line depended on the increase in loans, with an additional multiplier effect for loans granted to SME, that is, firms with sales of less than 100,000 UF.

Thus, the amount of the additional credit line is calculated as a percentage of the base portfolio. This percentage is obtained from the product of the increase in the annualized stock of loans, from March 16 (INC) plus 1% and ENF, which corresponds to the percentage of the flow of loans to SME over the total of commercial loans granted each period plus 20% (ie (1% + INC) * (20% + ENF)). The maximum amount of the additional line is 12% of the base portfolio./[1]

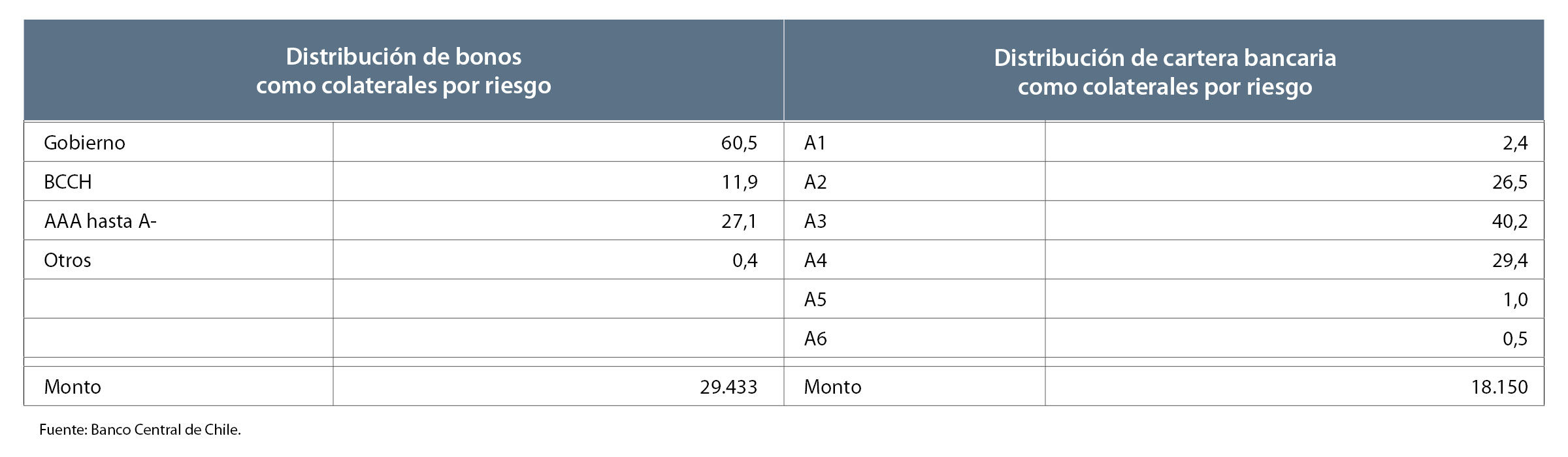

On May 6, 2020, eligible collaterals for the FCIC were expanded. These now included commercial loans that were rated as high-quality loans (A1 to A3 buckets).

It should be noted that the effectiveness of the FCIC depends on interaction with other measures. Among them, the increase in resources for state guarantees (FOGAPE and FOGAIN), the transitory flexibility of certain liquidity requirements, the extension of the financial services of the Central Bank of Chile to non-bank entities and the flexibility in provisions regulations, implemented by the Ministry of Finance, the Central Bank and the CMF (Central Bank of Chile, "Financial Stability Report". First semester, 2020).

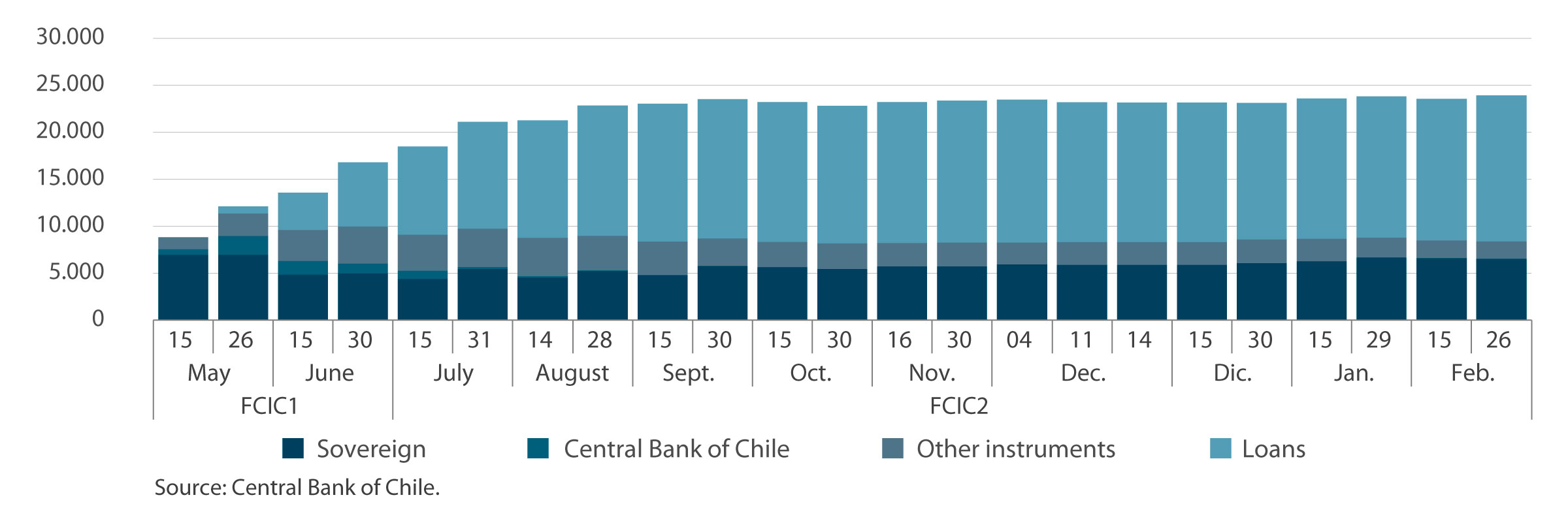

Use of FCIC

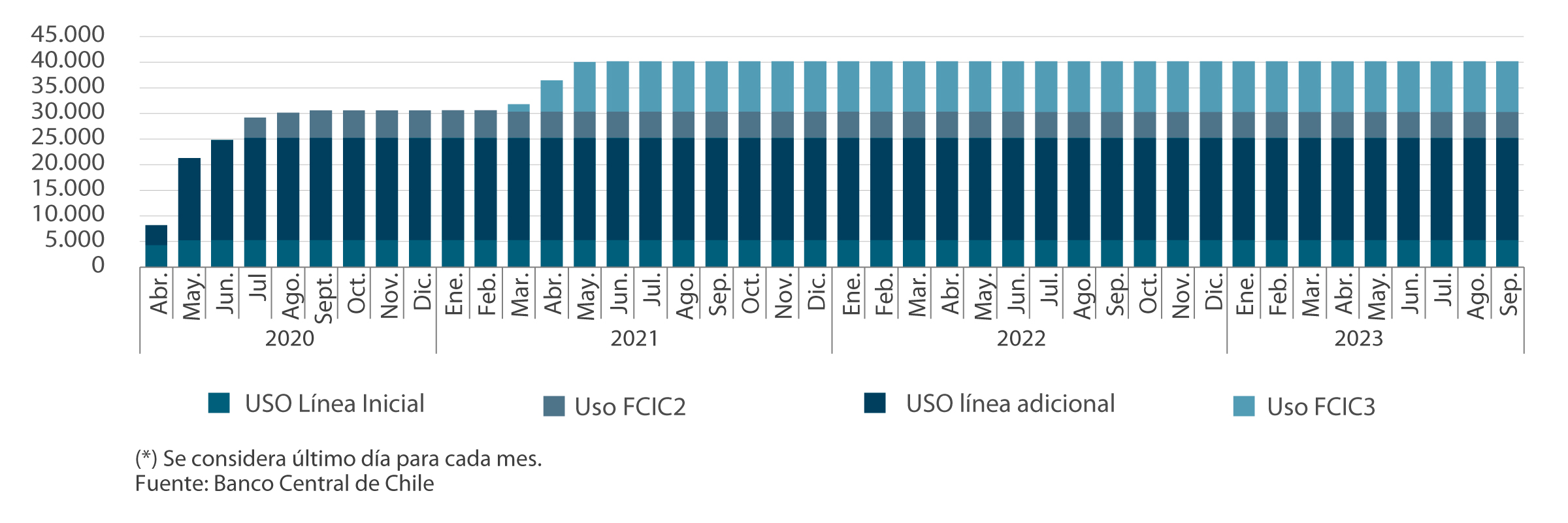

The initial line of the FCIC was fixed to US$4.8 billion, while the additional line was fixed to US$19.2 billion, and both lines could reach US$24 billion./[2] (Figure 1). To date, of the total number of banks established in Chile, 13 institutions have participated, making use of a significant percentage of the FCIC (Figure 2). Along with the use of the facility, the collaterals have progressively increased, and the composition by classification is detailed in Table 1.

Additional line and loan dynamics

In this section the use of the facility is reported along with the loan dynamics, and the data is compared to the FCIC announcement date/[3].

Figure 3 shows the information provided by banks, which is collected in a special form designed for this purpose. For the different periods (see Table 2), the evolution of the factor associated with the growth in the stock of loans and the factor associated with the participation of credit granted to SME are reported. In order to complement the previous information, Figure 4 shows the variation of the stock in the previous year and using similar periods.

[1]/ Further details in Board agreements N°2297E-01 (03/26/20) and 2304-01 (05/04/20).

[2]/ Nominal exchange rate is fixed at $796 per dollar, which is average value for February 2020.

[3]/ Special Monetary Policy minute (03/16/20).

Table 1: Collaterals by risk classification – information at July 22th

(percent)

Tabla 2: Information report periods

Graph 1: Amounts of Credit Lines Facilities

(millions of dollars)

Graph 2: Amounts of LCL and amounts of collaterals accepted by thee Central Bank of Chile

(millions of dollars)

Graph 3: Loan growth and targeted lending to small firms

(percent)

Graph 4: Stock changes of commercial loans

(millions of dollars)

FCIC II

En julio, el Banco dispuso una nueva Facilidad de Crédito Condicional al Incremento de las Colocaciones (FCIC II).

Luego de destinar más de US$ 22.000 millones, el BCCh dio paso a una nueva etapa de la FCIC, con un foco especial en el crédito a firmas (FCIC II). Dicha facilidad dispone de hasta US$ 15.600 millones, con un tope máximo por institución de US$ 3.900 millones y considera para su uso tres componentes que se detallan a continuación.

Primero, tienen acceso a la línea las instituciones que cumplan con un crecimiento de su cartera comercial en cuotas por sobre el stock sombra, que su vez, se calcula mensualmente aplicando una variación de 0.4% al saldo de mayo del 2020, de dicho segmento de colocaciones.

Segundo, el monto asignado de la FCIC II para cada mes es igual a 1,5 veces el flujo destinado en el mes precedente hacia créditos FOGAPE pertenecientes al programa Covid, a lo cual se suma el flujo de crédito destinado a Oferentes de Crédito no Bancario, que esté por sobre la base mensual, calculada como el promedio otorgado entre enero y mayo del 2020, a dicho segmento.

Tercero, en caso que, en un determinado mes, una empresa bancaria no pueda desembolsar su cupo mensual de la FCIC II, o pudiendo hacerlo, no lo retire íntegramente, puede solicitar el 20% del cupo no utilizado por el banco al mes siguiente junto con el cupo que le corresponda para ese nuevo mes.

Uso de línea FCIC II

En este apartado se reportan la dinámica de la FCIC II y su desembolso, hasta la fecha más reciente.

Para los primeros tres meses de funcionamiento se ha autorizado cerca de US$7.400 millones. A la fecha, 7 bancos han sido autorizados para para operar con la FCIC II, los cuales han hecho uso de la facilidad en un porcentaje significativo (Gráficos 1 y 2).

Finalmente, junto con la utilización de la facilidad, han aumentado progresivamente los colaterales recibidos por el BCCh, cuya composición por clasificación se detalla en la Tabla 1, la cual posee información tanto de la FCIC 1 como FCIC 2.

Table 1: Collaterals by risk classification – information at September 28th

(percent, millions of dollars)

Graph 1: Amounts of Credit Lines Facilities

(millions of dollars)

Graph 2: Use and Authorized amounts – FCIC2

(millions of dollars)

Graph 3: Accepted collaterals by the Central Bank of Chile

(millions of dollars)

[1]/ Para efectos de esta nota se considera un tipo de cambio igual a $793, correspondiente al promedio del mes de junio.

[2]/ Controlando por efectos de valoración del tipo de cambio.

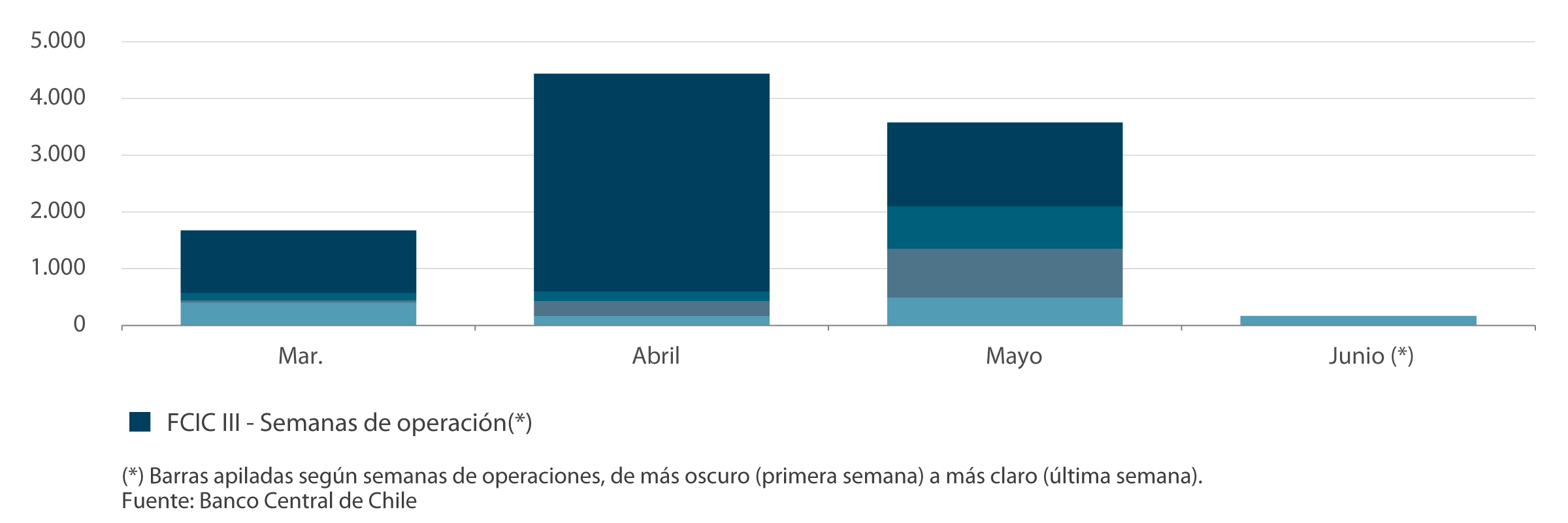

FCIC III

En marzo, el Banco dispuso una nueva Facilidad de Crédito Condicional al Incremento de las Colocaciones (FCIC 3).

El diseño de la FCIC contempló un monto total de US$ 40.000 millones. En marzo del presente año, el BCCh inició la tercera fase (FCIC 3) por un monto de US$ 10.000/[1] millones, equivalente al remanente no desembolsado de las etapas anteriores (FCIC 1 y FCIC 2). En particular, esta nueva etapa estuvo orientada a profundizar y extender la facilidad para contribuir al flujo de crédito comercial. Ello, ante la prolongación de la emergencia sanitaria y la necesidad de apoyar el proceso de reactivación, complementando el programa FOGAPE-Reactiva y así responder a las actuales necesidades financieras de las empresas. A continuación, se detallan las condiciones de acceso a esta facilidad.

Primero, el acceso a los fondos del programa FCIC 3 está vinculado al flujo de los créditos comerciales a empresas con ventas de hasta 1 millón de UF, con una ponderación mayor para créditos nuevos y reprogramaciones con garantía FOGAPE. Habrá un límite al acceso por banco de US$ 2.000 millones.

Segundo, el monto asignado de la FCIC 3 para cada mes es igual a 1 vez el flujo destinado en el mes precedente hacia créditos FOGAPE, a lo cual se suma el flujo de crédito destinado a empresas de menor tamaño por 0,7 veces.

Tercero, a diferencia de la FCIC 2, esta etapa no considera la existencia de un stock sombra, pero mantiene la posibilidad de ahorro del 20% de lo no retirado en el periodo anterior.

Uso de línea FCIC3

En este apartado se reportan la dinámica de la FCIC 3 y su desembolso, hasta la fecha más reciente.

Para los primeros 4 meses de funcionamiento, se ha hecho uso de la totalidad de la facilidad, completando así los US$ 10.000 millones asignados para esta etapa (Gráficos 1 y 2).

Finalmente, junto con la utilización de la facilidad, han aumentado progresivamente los colaterales recibidos por el BCCh, cuya composición por clasificación se detalla en la Tabla 1, la cual posee información consolidada de todas las FCIC.

Tabla 1: Colaterales por clasificación de riesgo – al 9 de Junio

(porcentaje, millones de dólares)

Gráfico 1: Montos de Facilidades de Crédito

(millones de dólares)

Gráfico 2: Montos de uso mensual de la FCIC 3

(millones de dólares)

Gráfico 3: Colaterales aceptados por el Banco Central de Chile.

(millones de dólares)

[1]/ Equivalente a $7.100.000 millones.

Press Releases

- Comunicado lunes, 23 de marzo de 2020, sobre: Banco Central informa condiciones de la Facilidad de Crédito Condicional al Incremento de las Colocaciones (FCIC) y medidas complementarias

- Comunicado jueves, 26 de marzo de 2020, sobre: Banco Central establece las normas sobre el financiamiento especial para las empresas bancarias orientadas a apoyar el financiamiento y refinanciamiento de créditos de hogares y empresas, junto con la flexibilización transitoria de su regulación sobre gestión de liquidez en la industria bancaria

- Comunicado miércoles, 8 de abril de 2020, Banco Central de Chile anuncia nuevas medidas

4. Maintaining cash flows

-

The CBC has maintained the normal flows of cash in the economy. This considers the withdrawal of low quality banknotes and keeping the supply of new bank notes to commercial banks.

-

Cash flow has been achieved while following all the recommendations of the World Health Organization in order to prevent the spread of Covid-19 among people that handle cash.

-

The CBC recommends that local stores continue to accept cash to guarantee that the public has a choice of payment methods for their purchases, particularly given the social restrictions imposed on the country due the sanitary crisis.

Glossary

Glossary – Measures of Central Bank of Chile

-

CBC Repo: Financing operation in domestic currency, where the Central Bank of Chile (CBC) buys or pledges to the banks, on a determined date, a set of financial assets in exchange for an amount in Chilean pesos, charging an interest rate that is generally the Monetary Policy Rate (MPR). When the operation ends, the bank returns the funds and the CBC returns the financial assets in exchange.

-

CBC Fx Swap: Financing operation in US dollars, granted by the CBC to the banks, where the latter pays back at maturity, and for which the CBC charges an interest rate. Since the beginning of the program, the CBC has auctioned these operations at a minimum rate of Libor + 200 basis points. For these operations, the CBC asks for a guarantee that is an equivalent in Chilean pesos and in return, the CBC pays the MPR. This operation temporarily reduces the International Reserves by the size of the loan amount, although it does not change the net position in foreign currency of the CBC.

-

PDBC: short-term debt securities issued by the CBC, with issuance terms between 7 and 360 days, which are purchased by banks, pension funds, open funds, insurance companies, and other agents.

-

CBC Spot foreign currency operation: Spot sale or purchase of foreign currency carries out by the CBC, for which it receives or delivers the equivalent amount in Chilean pesos. Banks, stockbrokers, and securities dealers participate in the auctions. This operation modifies the International Reserves and therefore the net position in foreign currency of the CBC.

-

CBC Foreign currency forward operation: Foreign currency forward sale or purchase carried out by the CBC, through which it commits to selling or buying foreign currency to banks in the future. If the operation involves a physical transaction, at maturity the CBC receives or delivers foreign currency in exchange for the equivalent amount in Chilean pesos. In the case of a Non-Delivery Forward (NDF), at maturity, the net amounts are calculated and the debtor pays the creditor the difference in Chilean pesos. This operation only modifies the International Reserves in the case of physical delivery, and not in the case of NDF; however, in both cases it alters the net position in foreign currency of the CBC. The operations carried out between 2019 and 2020 have been in the NDF modality.

-

CBC Conditional Financing Facility for Increased Loans (FCIC): It is an extraordinary financing facility for banks. This tool has been designed to be an incentive to financing households and companies, in particular those that do not have access to the financial market. It operates when the CBC buys or pledges to the banks, on a given date, a set of financial assets in exchange for the equivalent amount in Chilean pesos, charging the minimum among the MPR values during the period March - September 2020.

-

CBC Liquidity Credit Line (LCL): It is a liquidity credit facility activated by the CBC, whose limit corresponds to the Average Reserve Requirement in domestic currency of each bank. The access and use of the LCL is subject to the same conditions established for the FCIC, with the difference that its limit is the Reserve Requirement of each bank. The LCL has a 6-month availability period and a maturity of up to 2 years. The CBC supplies an amount in Chilean pesos up to the reserve requirement limit, charging the minimum among the MPR values during the period March - September 2020.

-

Liquidity Coverage Ratio (LCR): It measures the liquidity risk profile of a bank; ensuring that it has an adequate amount of high quality and charge-free assets that can be easily and immediately converted into cash.