Estimating unobservables

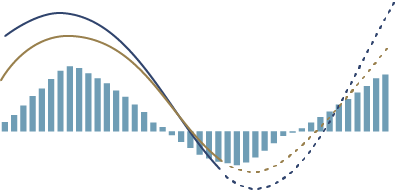

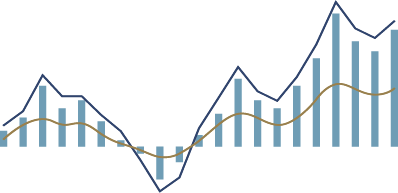

An important part of monetary policy decisions are based on gaps between observable variables, such as the interest rate or GDP, and some unobservable counterpart, such as the neutral interest rate and potential and/or trend GDP, respectively. Thus, for example, the interest rate will be contractionary, helping to contain inflation, if it is above its neutral level. Similarly, activity will be in an expansionary cycle, generating inflationary pressures, if actual GDP is above potential.

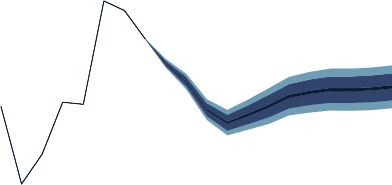

The correct estimation of these variables is of utmost importance to correctly evaluate monetary policy. These variables cannot be observed directly and must be inferred by a combination of statistical methods and economic theory. This inference obviously has a significant degree of uncertainty, as it is based on estimates from multiple models, each with its own degree of uncertainty. The judgment of the staff and the Board determines, through a critical analysis of the different estimates, the values to be used to calibrate monetary policy. The estimates are updated annually, and the results are made public in the monetary policy reports.

For details, see “Use of Macroeconomic Models at the Central Bank of Chile.