Sistema de pagos 2

In this page

-

Large Value Payment Systems

-

Low Value Payment Systems

-

Principles for Financial Market Infrastructures (PFMI)

-

Regulation, Documents and Statistics

-

Procedure for accessing the RTGS System

Payment systems are vital for the proper functioning of modern economies. In particular, they enable the completion of financial transactions, payments for goods and services of the real sector, and the implementation of the monetary policy of the Central Bank of Chile. According to its international definition, a payment system comprises a series of instruments, procedures and regulations for the transfer of funds between two or more participants, and is composed by the system operator and its participants.

The Constitutional Organic Law establishes as one of the mandates of the Central Bank of Chile to ensure the normal functioning of payments. The Central Bank fulfills this mandate by regulating payment systems and by operating the Real-Time Gross Settlement System. In both roles, its objectives are to increase the security and efficiency of payment systems, considering the application of the minimum standards and requirements suggested by international organizations concerning this matter.

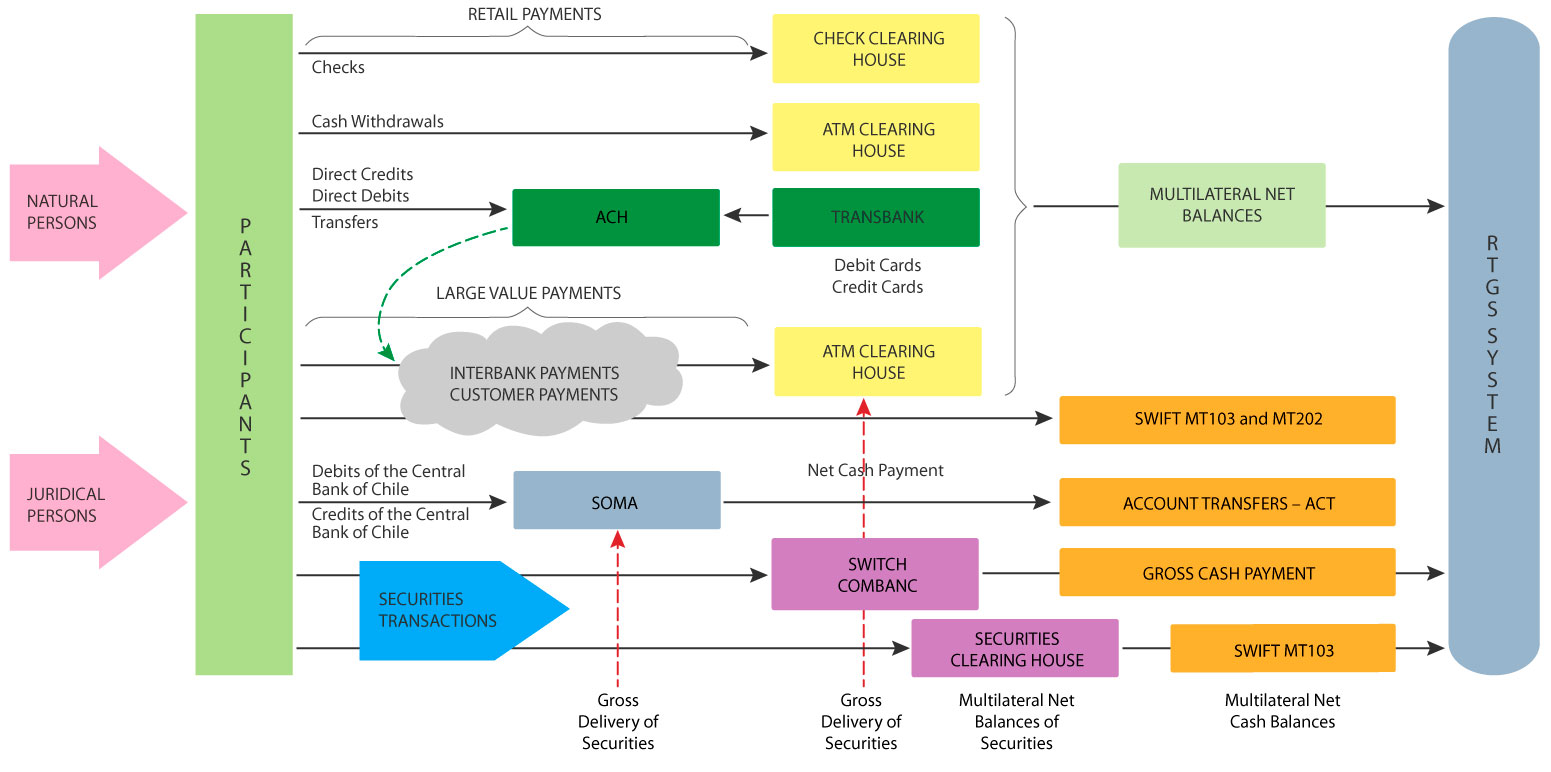

Relations between the Main Players of the Payment System in Chile (Table)

Large Value Payment Systems

Large value payment systems provide the means to transfer funds of large value and importance to the economy (1). In Chile, these systems comprise the Real-Time Gross Settlement system, managed by the Central Bank of Chile, and the Large Value Payments Clearing House system, managed by ComBanc, a Bank Draft Support Company.

While in the first system the settlement of transactions is carried out immediately and severally, in the second one the clearing of all payment orders received during the day takes place, in order to subsequently settle a single daily net balance for each bank in the Real-Time Gross Settlement system.

Both systems process interbank transactions on behalf of clients and transactions from the Over-the-Counter securities market.

Normativas - Compendios (CNF y CNMF)

- Sistemas de Pago (Cap III.H)

- Capítulo Protocolo de Contingencias SPAV Cap III.H.2

- Sistema de Liquidación Bruta en Tiempo Real (Sistema LBTR) Cap III.H.4

- Sistema de Liquidación Bruta en Tiempo Real en Moneda Nacional del Banco Central de Chile (Sistema LBTR MN) Cap III.H.4.1

- Reglamento Operativo (RO) del Sistema LBTR en Moneda Nacional Cap III.H.4.1.1

- Sistema de Liquidación Bruta en Tiempo Real en Dólares del Banco Central de Chile (Sistema LBTR USD) Cap III.H.4.2

- Reglamento Operativo (RO) del Sistema LBTR en Dólares Cap III.H.4.2.1

- Cámaras de Compensación de Pagos de Alto Valor en Moneda Nacional Cap III.H.5

Documentos

- Chile FSAP Stand-alone PFMI-LBTR

- Chile FSAP Stand-alone ROSC PFMI CCLV-CCP

- Chile FSAP Stand-alone ROSC PFMI CCLV-SSS

- Chile FSAP Stand-alone ROSC PFMI ComBanc

- Chile FSAP Stand-alone ROSC PFMI ComDer

- Chile FSAP Stand-alone ROSC PFMI DCV

- Chile FSAP Stand-alone ROSC PFMI Responsibilities

- Compromiso Conjunto de Autoridades Chilenas para el Cumplimiento de los Principios para las Infraestructuras del Mercado Financiero

- Marco de divulgación sobre la observancia de PFMI en el sistema LBTR

- Gestión de Sistemas de Pagos de Alto Valor 2017

- Gestión de Sistemas de Pagos de Alto Valor 2012

- Entidad de Contraparte Central (IEF, Anexo IV.1 del primer semestre del 2007)

- Mejores prácticas sobre continuidad operacional (IEF, recuadro del segundo semestre del 2006)

- Entrega contra pago en los sistemas de liquidación de valores (IEF, recuadro del primer semestre del 2006)

- Utilización de los medios de pago minoristas en el período 1998-2005 (IEF, recuadro del primer semestre del 2006)

- Modernización de los sistemas de pagos en Chile (IEF, recuadro del primer semestre del 2004).

- Sistemas de pagos (IPOM, recuadro de mayo del 2003).

- Convenio sobre Protocolo de Contingencia para Sistemas de Pago de Alto Valor

- Modernización del sistema de pagos (Grupo de trabajo sobre sistemas de pagos, agosto del 2003).

- "Modernización del Sistema de Pagos en Chile. Luis Oscar Herrera, Gerente División Política Financiera del Banco Central de Chile, en el XI Encuentro Latinoamericano de usuarios de Swift–Elus 2006. 4 de julio, 2006."

- Comunicado sobre sistemas de pagos (septiembre del 2000).

Estadísticas Disponibilidad LBTR

| ene-25 | feb-25 | mar-25 | abr-25 | may-25 | jun-25 | jul-25 | ago-25 | sept-25 | oct-25 | nov-25 | dic-25 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Disponibilidad del servicio |

99,57% | 99,17% | 99,77% | 100,00% | 100,00% | 99,95% | 100,00% | |||||

|

Interrupciones (minutos) |

49 | 85 | 25 | 0 | 0 | 5 | 0 | |||||

|

Retraso en liquidación de Cámaras* (minutos) |

0 | 0 | 0 | 0 | 2 | 0 | 0 |

| ene-24 | feb-24 | mar-24 | abr-24 | may-24 | jun-24 | jul-24 | ago-24 | sept-24 | oct-24 | nov-24 | dic-24 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Disponibilidad del servicio |

99,18% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 99,34% |

|

Interrupciones (minutos) |

92 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 68 |

|

Retraso en liquidación de Cámaras* (minutos) |

0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 2 | 0 | 0 | 0 |

| ene-23 | feb-23 | mar-23 | abr-23 | may-23 | jun-23 | jul-23 | ago-23 | sept-23 | oct-23 | nov-23 | dic-23 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

Disponibilidad del servicio |

100,00% | 99,90% | 100,00% | 100,00% | 100,00% | 99,23% | 99,79% | 99,85% | 100% | 100% | 100% | 99,56% |

|

Interrupciones (minutos) |

0 | 10 | 0 | 0 | 0 | 79 | 23 | 17 | 0 | 0 | 0 | 43 |

|

Retraso en liquidación de Cámaras* (minutos) |

0 | 0 | 0 | 0 | 4 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ene-22 | feb-22 | mar-22 | abr-22 | may-22 | jun-22 | jul-22 | ago-22 | sept-22 | oct-22 | nov-22 | dic-22 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Disponibilidad del servicio | 100,00% | 100,00% | 100,00% | 100,00% | 99,91% | 100,00% | 99,95% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% |

| Interrupciones (minutos) | 0 | 0 | 0 | 0 | 10 | 0 | 5 | 0 | 0 | 0 | 0 | 0 |

| Retraso en liquidación de Cámaras* (minutos) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 30 | 0 | 0 | 0 | 127 |

| ene-21 | feb-21 | mar-21 | abr-21 | may-21 | jun-21 | jul-21 | ago-21 | sept-21 | oct-21 | nov-21 | dic-21 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Disponibilidad del servicio | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% |

| Interrupciones (minutos) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Retraso en liquidación de Cámaras* (minutos) | 0 | 0 | 23 | 0 | 38 | 0 | 0 | 240 | 0 | 0 | 110 | 0 |

| ene-20 | feb-20 | mar-20 | abr-20 | may-20 | jun-20 | jul-20 | ago-20 | sept-20 | oct-20 | nov-20 | dic-20 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Disponibilidad del servicio | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 99,91% | 100,00% | 100,00% | 100,00% | 100,00% |

| Interrupciones (minutos) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 10 | 0 | 0 | 0 | 0 |

| Retraso en liquidación de Cámaras* (minutos) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| ene-19 | feb-19 | mar-19 | abr-19 | may-19 | jun-19 | jul-19 | ago-19 | sept-19 | oct-19 | nov-19 | dic-19 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Disponibilidad del servicio | 100,00% | 100,00% | 100,00% | 99,59% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 99,59% |

| Interrupciones (minutos) | 0 | 0 | 0 | 44 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 41 |

| Retraso en liquidación de Cámaras* (minutos) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 5 | 21 | 39 | 0 | 0 |

| ene-18 | feb-18 | mar-18 | abr-18 | may-18 | jun-18 | jul-18 | ago-18 | sept-18 | oct-18 | nov-18 | dic-18 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Disponibilidad del servicio | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 99,73% | 99,80% | 100,00% |

| Interrupciones (minutos) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 31 | 21 | 0 |

| Retraso en liquidación de Cámaras* (minutos) | 0 | 0 | 4 | 0 | 0 | 0 | 2 | 0 | 0 | 5 | 0 | 0 |

| ene-17 | feb-17 | mar-17 | abr-17 | may-17 | jun-17 | jul-17 | ago-17 | sept-17 | oct-17 | nov-17 | dic-17 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Disponibilidad del servicio | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% |

| Interrupciones (minutos) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Retraso en liquidación de Cámaras* (minutos) | 0 | 2 | 5 | 0 | 0 | 11 | 0 | 0 | 0 | 1 | 0 | 0 |

| ene-16 | feb-16 | mar-16 | abr-16 | may-16 | jun-16 | jul-16 | ago-16 | sept-16 | oct-16 | nov-16 | dic-16 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Disponibilidad del servicio | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% | 100,00% |

| Interrupciones (minutos) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| <>Retraso en liquidación de Cámaras* (minutos) | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 5 |

(*)= Comprende el retraso acumulado en la liquidación de las Cámaras de: Cheques, Cajeros y CCAV.

Estadísticas Sistema LBTR

| I Trimestre | II Trimestre | III Trimestre | IV Trimestre | Total 2025 | |

|---|---|---|---|---|---|

| Monto total de pagos (**) | 1.756.155.191 | 1.952.147.630 | 3.708.302.821 | ||

| Número de pagos | 102.011 | 107.385 | 209.396 |

| I Trimestre | II Trimestre | III Trimestre | IV Trimestre | Total 2024 | |

|---|---|---|---|---|---|

| Monto total de pagos (**) | 2.195.135.300 | 2.060.074.623 | 1.795.553.905 | 2.087.307.455 | 8.138.071.283 |

| Número de pagos | 115.040 | 104.443 | 97.194 | 105.438 | 422.115 |

| I Trimestre | II Trimestre | III Trimestre | IV Trimestre | Total 2023 | |

|---|---|---|---|---|---|

| Monto total de pagos (**) | 2.397.264.180 | 2.313.673.540 | 2.474.977.065 | 2.570.767.056 | 9.756.681.841 |

| Número de pagos | 110.428 | 112.253 | 109.284 | 114.984 | 446.949 |

| I Trimestre | II Trimestre | III Trimestre | IV Trimestre | Total 2022 | |

|---|---|---|---|---|---|

| Monto total de pagos (**) | 2.658.347.136 | 2.675.427.808 | 2.583.835.248 | 2.395.148.705 | 10.312.758.897 |

| Número de pagos | 104.520 | 108.607 | 112.297 | 108.236 | 433.660 |

| I Trimestre | II Trimestre | III Trimestre | IV Trimestre | Total 2021 | |

|---|---|---|---|---|---|

| Monto total de pagos (**) | 3.411.138.340 | 3.737.711.059 | 2.603.442.263 | 2.394.576.129 |

12.146.867.791 |

| Número de pagos | 102.664 | 104.969 | 100.671 | 105.288 | 413.592 |

| I Trimestre | II Trimestre | III Trimestre | IV Trimestre | Total 2020 | |

|---|---|---|---|---|---|

| Monto total de pagos (**) | 1.225.067.808 | 2.236.653.861 | 3.270.664.343 | 3.360.681.792 | 10.093.067.804 |

| Número de pagos | 105.010 | 106.441 | 105.274 | 105.710 | 422.435 |

| I Trimestre | II Trimestre | III Trimestre | IV Trimestre | Total 2019 | |

|---|---|---|---|---|---|

| Monto total de pagos (**) | 908.214.062 | 978.308.428 | 952.414.126 | 1.222.936.166 | 4.061.872.781 |

| Número de pagos | 117.813 | 117.726 | 106.352 | 106.485 | 448.376 |

| I Trimestre | II Trimestre | III Trimestre | IV Trimestre | Total 2018 | |

|---|---|---|---|---|---|

| Monto total de pagos (**) | 920.968.875 | 973.241.387 | 803.007.442 | 964.122.391 | 3.661.340.095 |

| Número de pagos | 92.035 | 100.260 | 96.873 | 121.892 | 411.060 |

(**)= Montos expresados en millones de $

| I Trimestre | II Trimestre | III Trimestre | IV Trimestre | Total 2017 | |

|---|---|---|---|---|---|

| Monto total de pagos (**) | 737.232.354 | 730.803.677 | 724.559.652 | 802.360.179 | 2.994.955.862 |

| Número de pagos | 82.805 | 79.813 | 80.318 | 86.708 | 329.644 |

| I Trimestre | II Trimestre | III Trimestre | IV Trimestre | Total 2016 | |

|---|---|---|---|---|---|

| Monto total de pagos (**) | 724.392.583 | 785.901.578 | 728.584.911 | 697.476.011 | 2.936.355.082 |

| Número de pagos | 92.881 | 91.022 | 84.905 | 82.727 | 351.535 |

(**)= Montos expresados en millones de $

Links a organismos internacionales

Low Value Payment Systems

Low value payment systems, also known as retail payment systems, are used to make payments and transfer funds between individuals and/or companies, and characteristically process a large number of transactions of lower relative individual value, usually linked to the purchase and sale of goods and services.

In Chile, payments of this kind are made through a variety of instruments such as cash, checks, credit and debit cards, and electronic transfers. Checks and ATM transactions settle each participant’s net balances in the Real-Time Gross Settlement system every day, which are determined in specialized clearing houses.

Política Financiera – Regulación Prudencial - Innovación Financiera y Medios de Pago

Normativa

La normativa del Banco Central de Chile aplicable a los Emisores y Operadores de Tarjetas de Pago está conformada por:

- Capítulo III.H.1 Cámara de Compensación de Cheques y otros documentos en moneda nacional en el pais.

- Capítulo III.H.3 Cámara de Compensación de Operaciones efectuadas a través de cajeros automáticos en el país

- Capítulo III.J.1, Emisores de Tarjetas de Pago, del Compendio de Normas Financieras

- Capítulo III.J.1.1, Emisores de Tarjetas de Crédito, del Compendio de Normas Financieras

- Capítulo III.J.1.2, Emisores de Tarjetas de Débito, del Compendio de Normas Financieras

- Capítulo III.J.1.3, Emisores de Tarjetas de Pago con Provisión de Fondos, del Compendio de Normas Financieras

- Capítulo III.J.2, Operadores de Tarjetas de Pago, del Compendio de Normas Financieras

Formularios del Compendio de Normas de Cambios Internacionales

Este servicio es para que las personas jurídicas y naturales cumplan con la entrega de información al Banco Central de Chile, de acuerdo a lo establecido en el Compendio de Normas de Cambios Internacionales

Consultas: contactocentral.bcentral.cl