Projection Models

Projection models

What are they?

Economic models are abstract simplifications of reality, which require using several simplifying assumptions and may include a limited number of economic agents, relationships, and mechanisms.

What is their role?

• Organizing the analytical framework with which the monetary policy pass-through mechanisms are studied.

• Supporting the decisions of the Central Bank Board through the creation of projections for the relevant economic variables.

• Enabling the understanding and quantification of the most likely way in which the economy —particularly inflation— will respond to various situations and to changes in monetary policy.

• Core models (frequently used): which seek to capture the monetary policy pass-through mechanisms that are considered relevant most of the time, and are therefore used with greater frequency and intensity.

• Auxiliary models (satellites): which allow contrasting the results of the main models and facilitate the analysis of less frequently occurring phenomena that are not captured by these models.

• Structural, incorporating constraints derived from economic theory. They are useful for understanding the rationale behind expected behaviors in the medium term and for performing counterfactual and alternative scenario tests.

• Econometrical, emphasizing the historical correlations between variables. Used to generate a view on the most likely future behavior of the variables of interest in the short term.

• It must be present in all stages of the process of constructing the projection scenarios —both national and international, as well as short and medium term— which provide the grounds for monetary policy decisions.

• The technical staff brings to the discussion its expertise on quantitative elements not considered, and quantitative and qualitative information obtained through surveys conducted by the Central Bank and other institutions.

• Also from the Central Bank Board's feedback to the central and sensitivity scenarios.

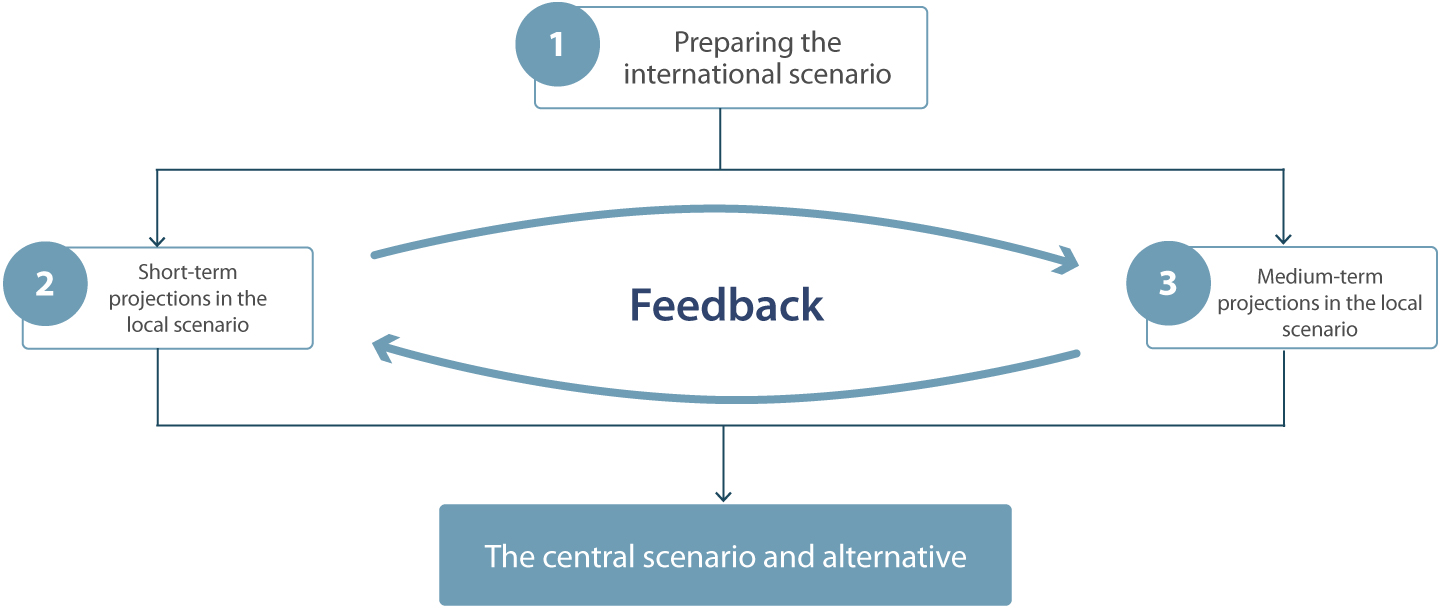

Projection process outline

This process is carried out in full once every quarter, coinciding with the publication of each Monetary Policy Report. The process of preparing these reports involves four formal meetings between the staff and the Board, covering the following topics:

International scenario

Local scenario: conjunctural background

Local scenario: short-term projections and medium-term baseline scenario

Monetary policy options, sensitivity and risk scenarios

For those monetary policy meetings that do not coincide with the publication of an MP Report, a narrower exercise is carried out, mainly updating the projections scenarios for both the global and the local economy.