Global results of the 2022 Triennial Central Bank Survey of turnover in foreign Exchange and over-the-counter (OTC) interest rate derivatives markets coordinated by the Bank for International Settlements (BIS)

Press

Thursday, October 27, 2022

Global results of the 2022 Triennial Central Bank Survey of turnover in foreign Exchange and over-the-counter (OTC) interest rate derivatives markets coordinated by the Bank for International Settlements (BIS)

Today the BIS published results of the 2022 Triennial Survey of turnover in FX and OTC interest rate derivatives markets that took place in April. This Survey is the most comprehensive source of information on the size and structure of global OTC markets in FX and interest rate derivatives and it aims to increase the transparency of OTC markets, help central banks and market participants monitor global financial markets, and inform discussions on reforms to OTC markets.

FOREIGN EXCHANGE MARKET

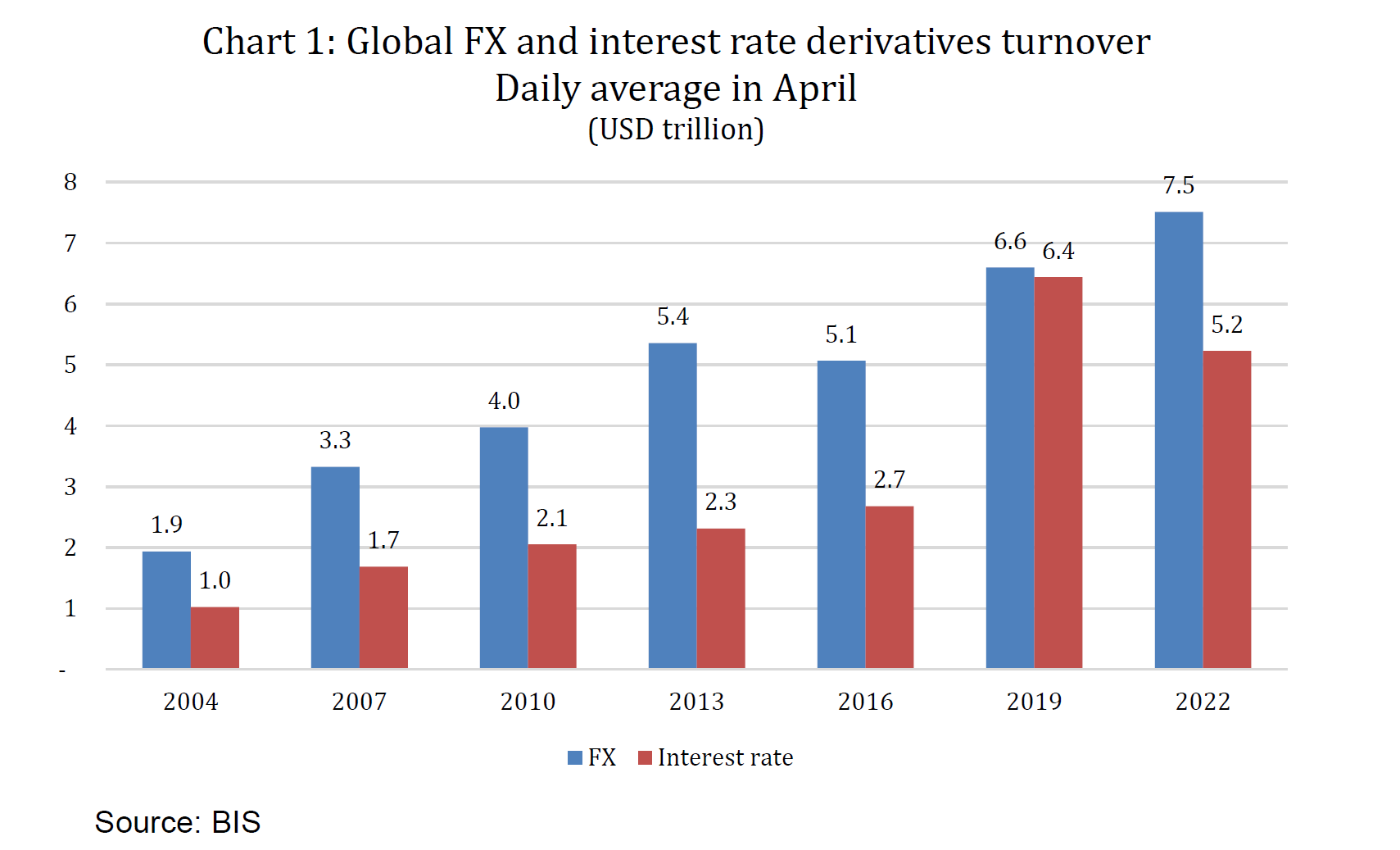

Global daily average FX turnover reached US$7.5 trillion in April 2022, up 14% from $6.6 trillion three years earlier. This growth coincided with heightened FX volatility due to changing expectations about the path of future interest rates in major advanced economies, rising commodity prices and geopolitical tensions following the start of the war in Ukraine (Chart 1).

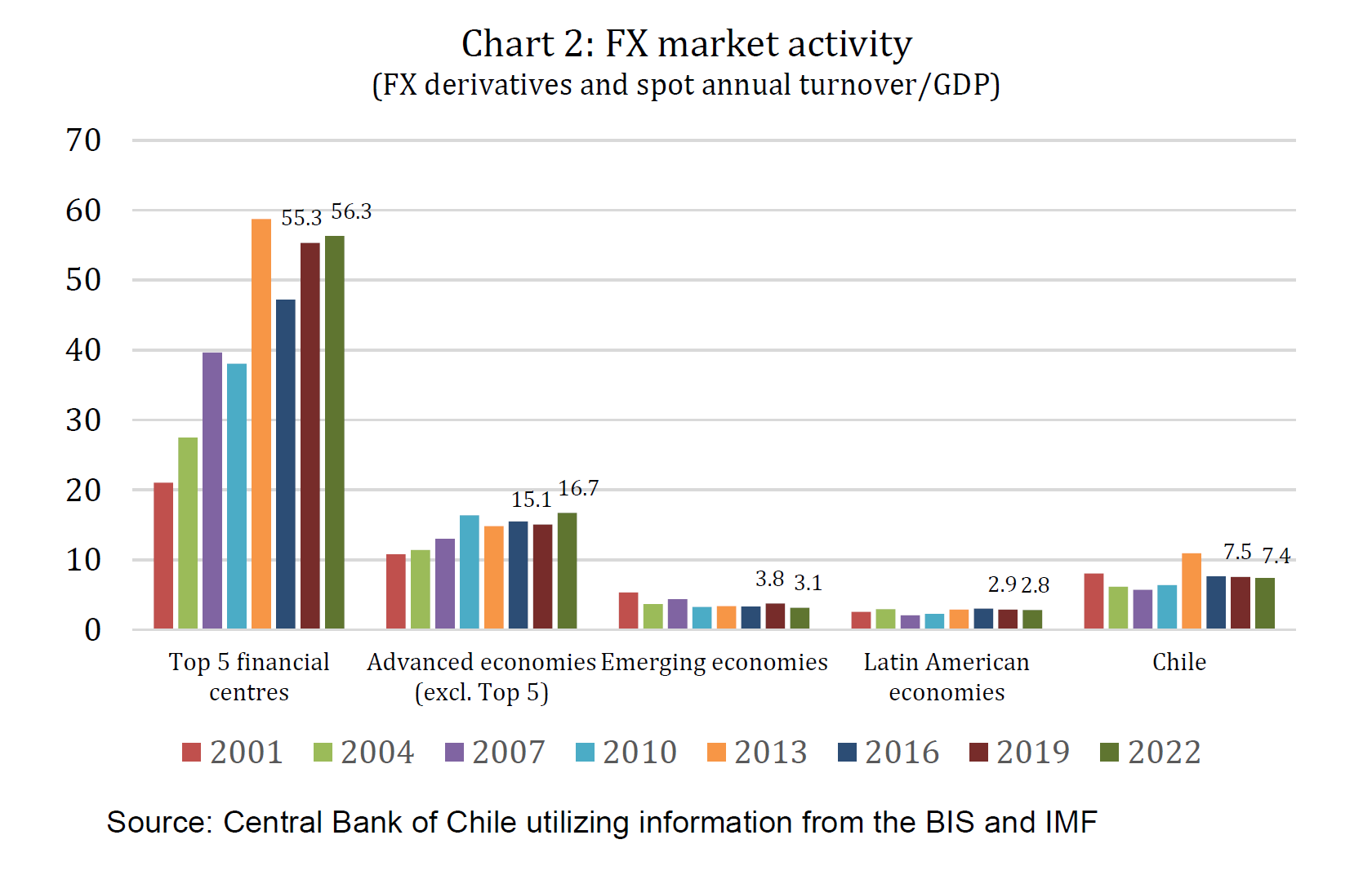

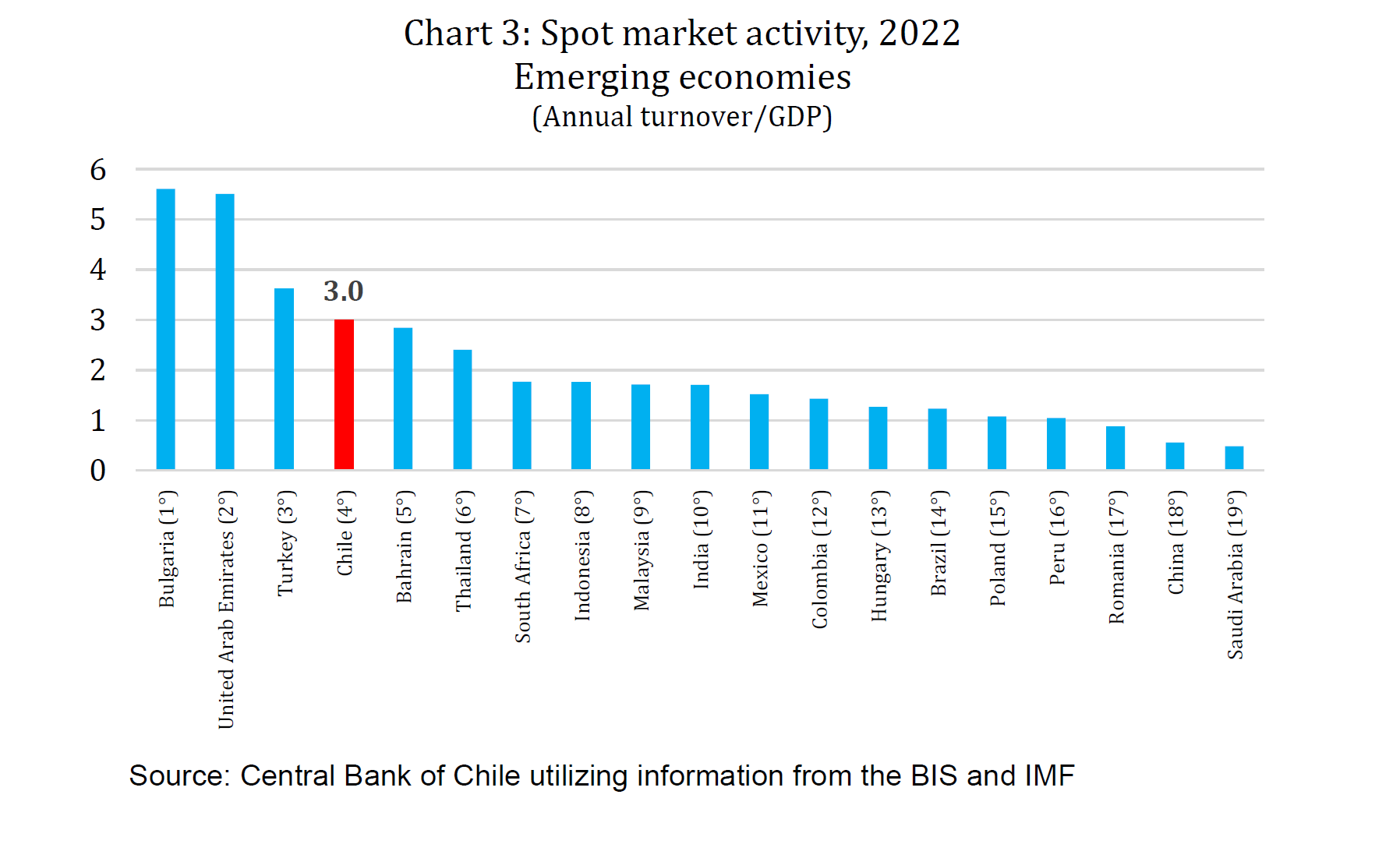

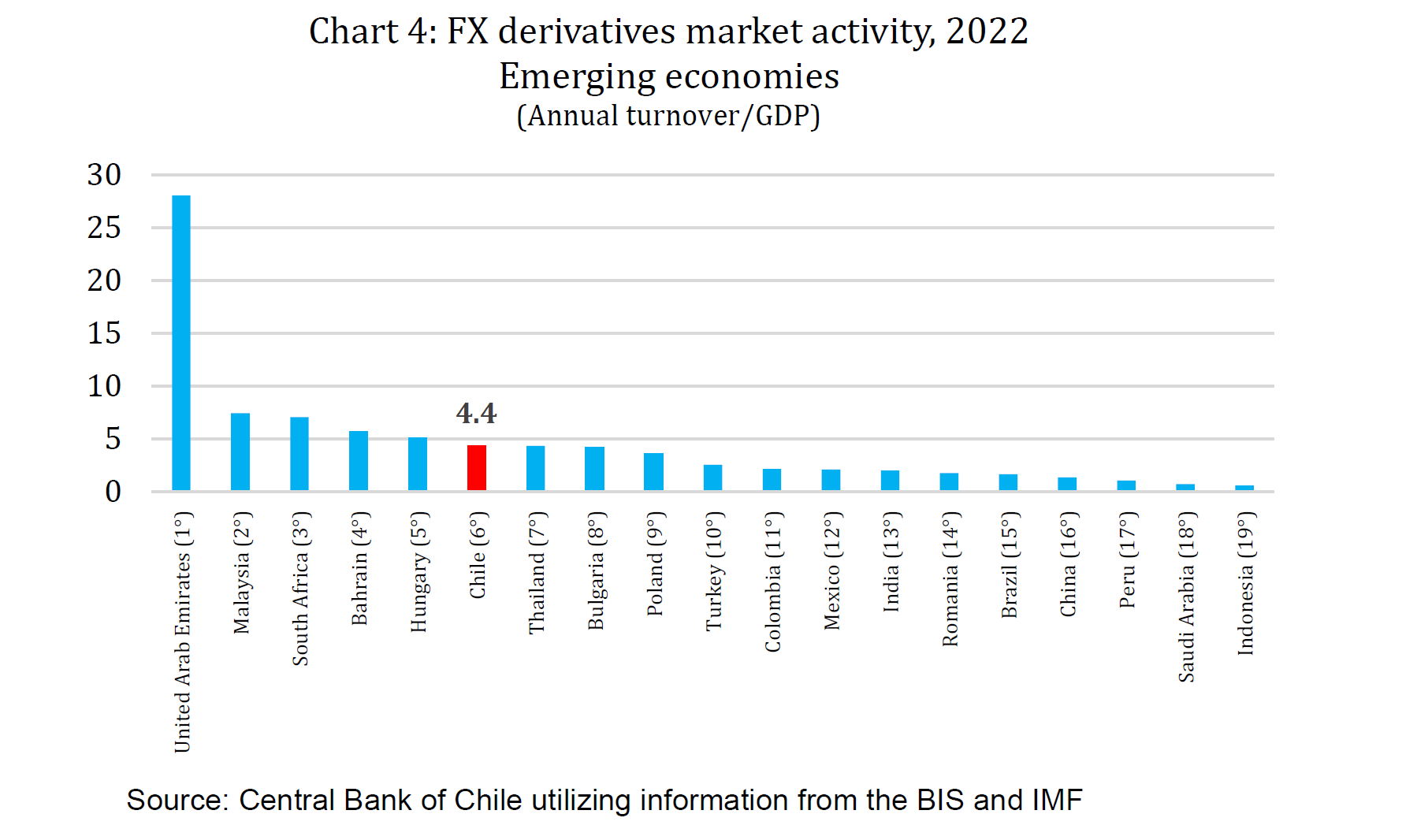

FX activity in Chile was equivalent to 7.4 times GDP in 2022, above the average of emerging economies (Chart 2). When ranked amongst these emerging economies, Chile maintains its fourth placing (same as 2019) in the spot market and reaches sixth in the FX derivatives market (Charts 3 & 4).

INTEREST RATE DERIVATIVES MARKET

Turnover of OTC interest rate derivatives averaged US$5.2 trillion per day in April 2022, 19% less than in April 2019. This decline was influenced by reduced turnover of Forward Rate Agreements (FRAs) following the transition from the use of Libor as a reference rate at the end of 2021, mainly affecting contracts tied to the US dollar, as indicated by the BIS (Chart 1).

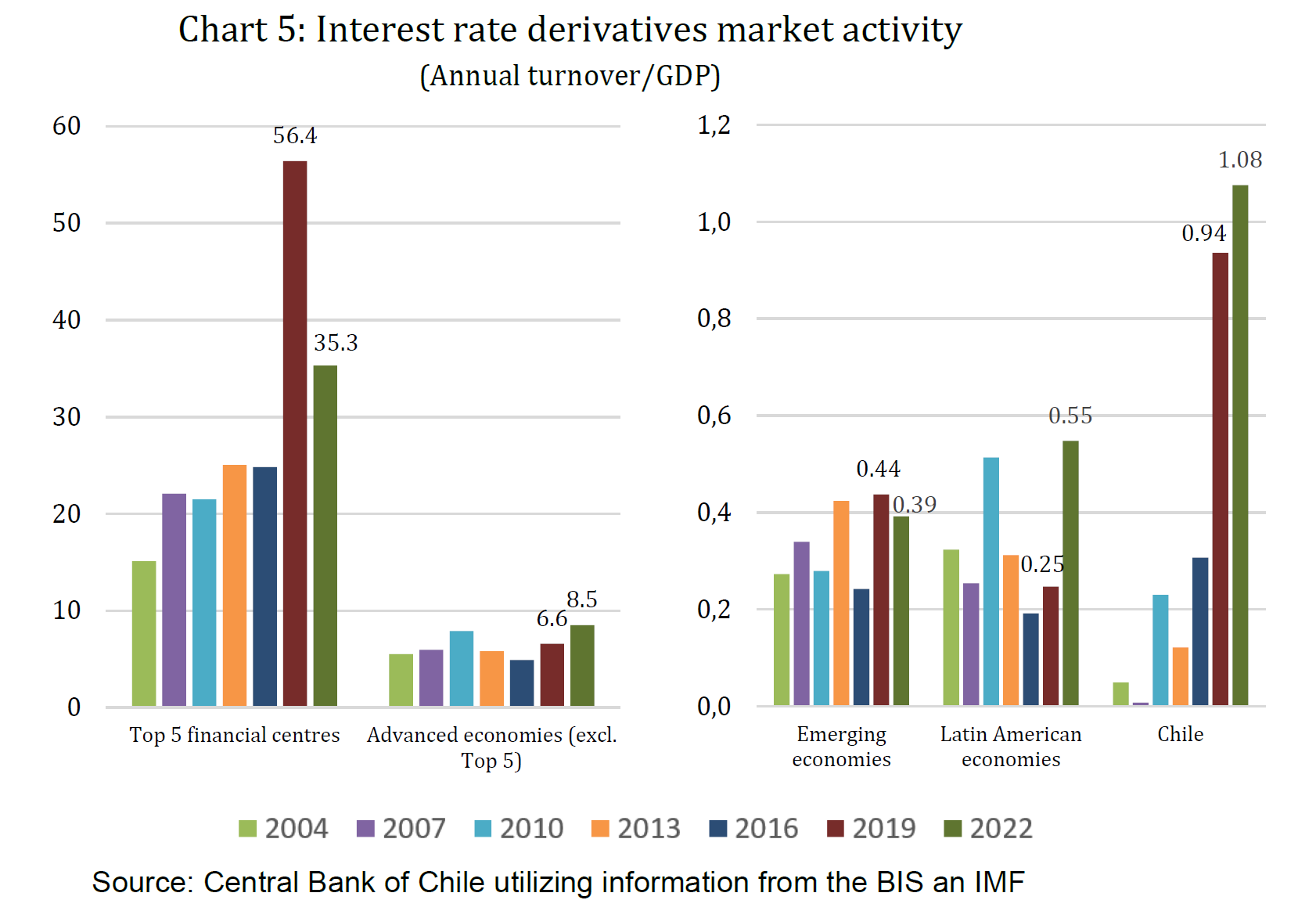

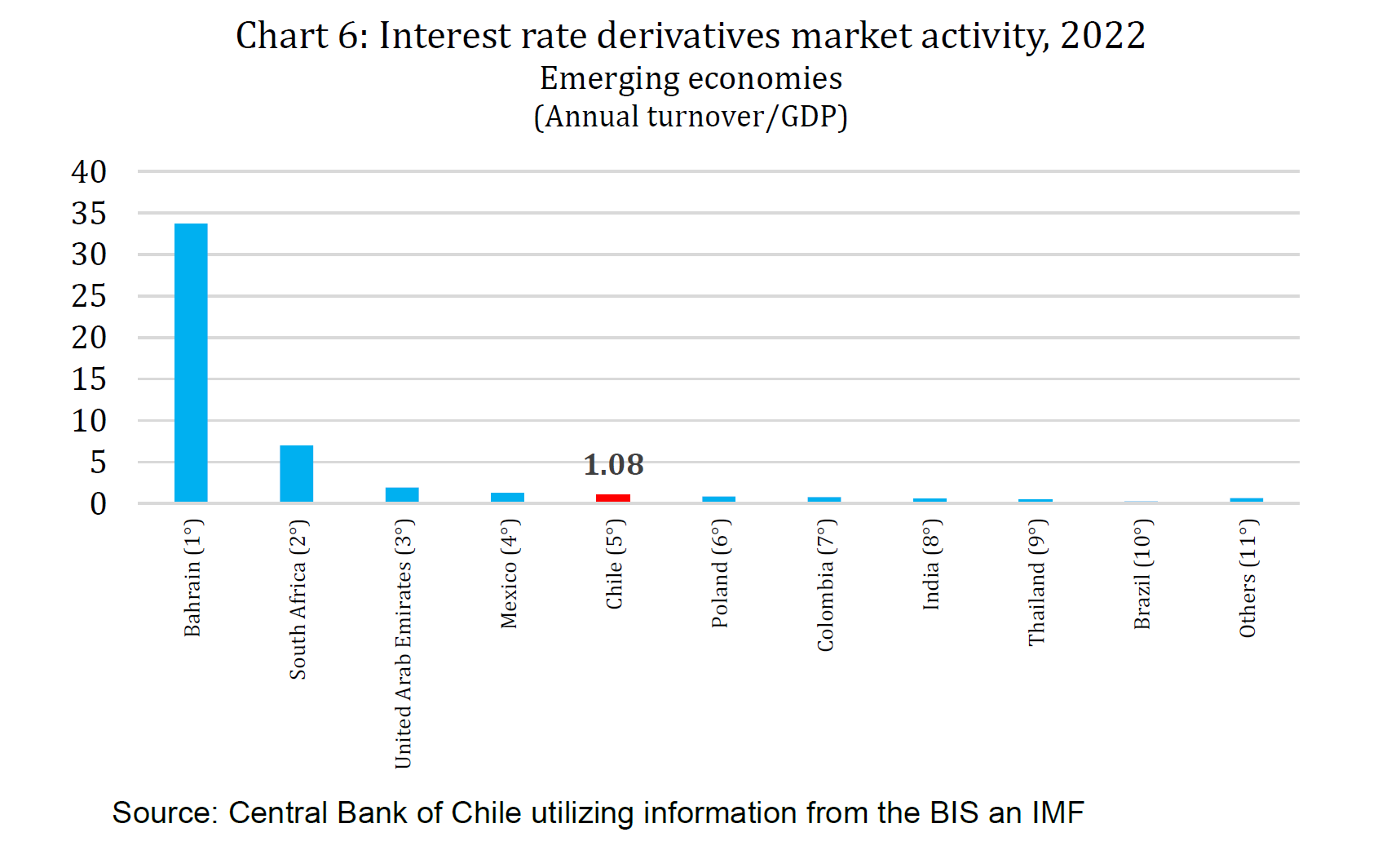

Interest rate derivatives activity in Chile increased to 1.08 times GDP in 2022 (0.9 in 2019), higher than the average of emerging and Latin-American economies and ranking fifth amongst them (Charts 5 & 6). This increase can be linked to greater participation of non-residents in the local market who trade on expectations of changes in the official central bank policy rate.

Global results published by the BIS are available through the following link: https://www.bis.org/statistics/rpfx22.htm