Content: Financial Stability Report Duplicate 1

The purpose of the Financial Stability Report is to provide information on a semiannual basis concerning recent macroeconomic and financial events that may affect the financial stability of the Chilean economy, such as the evolution of indebtedness of the main credit users, the performance of the capital market, and the capacity of the financial system and of the international financial position to adapt adequately to adverse economic situations. In addition, the Financial Stability Report presents the policies and measures that contribute to the normal functioning of the financial system, in order to promote public knowledge and debate concerning these issues.

The release of the 2021 Financial Stability Reports will be on May 5 th and November 3 th.

Description of the Financial Stability Report

Objective

The financial system contributes to efficient resource allocation, by channeling funds from savers to those with financing needs, a cornerstone of economic growth. However, it is subject to inherent risks, such as liquidity, credit, contagion, and operational risks. Thus, a particular adverse event could become systemic in the face of vulnerabilities that amplify its impact.

The conceptual framework employed by the Bank considers the financial system to be stable when it performs its functions normally or without relevant disruptions, even in the face of temporary adverse situations. In this way, the appropriate identification of potential risk events, vulnerabilities and mitigating factors, along with impact assessments, contribute to the understanding of the stability of the financial system and make it possible to outline policy measures within the Bank’s scope of action, as well as to recommend others that are a springboard for other financial regulators.

In this context, the Financial Stability Report is the main instrument for communicating various diagnoses concerning the state of the financial system. In particular, the Financial Stability Report presents the Board’s view on the main external and local risks to financial stability. It also reviews the most relevant issues in financial regulation at domestic and international level. Thus, the Bank seeks to actively contribute to the stability of the financial system by providing information, risk analysis and warnings concerning trends that deserve greater attention.

Analysis Framework for Financial Policy

Ensuring financial stability requires a prospective and continuous framework of analysis, the final result of which enables the elaboration of a comprehensive diagnosis of potential risks, vulnerabilities and mitigating factors. The objective of this diagnosis is to contribute to the decision-making processes of the financial system’s participants, as well as of regulatory and supervisory institutions.

In general terms, the Bank’s analysis framework consists in monitoring and studying the financial system’s players (households, companies, credit providers), its components (intermediaries, markets and infrastructures), and the interconnections between them. This analysis is highly demanding in terms of data, research, constant monitoring of best practices and international experience, development of analytical tools and interaction with different regulators and players of the financial sector.

The analysis framework considers a continuous process that enables the identification of potential shocks, vulnerabilities that could amplify them and mitigating factors that could limit their scope, thus assessing their potential impact (Figure 1). This process enables the elaboration of diagnoses regarding the state of the Financial System.

Dissemination

The Financial Stability Report has been published semiannually since 2004. Its contents are disseminated through various channels, including presentations to the Senate’s Finance Committee, authorities and other specialized audiences composed by various financial market participants, and to the general public. Likewise, all statistical information contained in the Financial Stability Report is available on the Bank’s website.

Evaluation

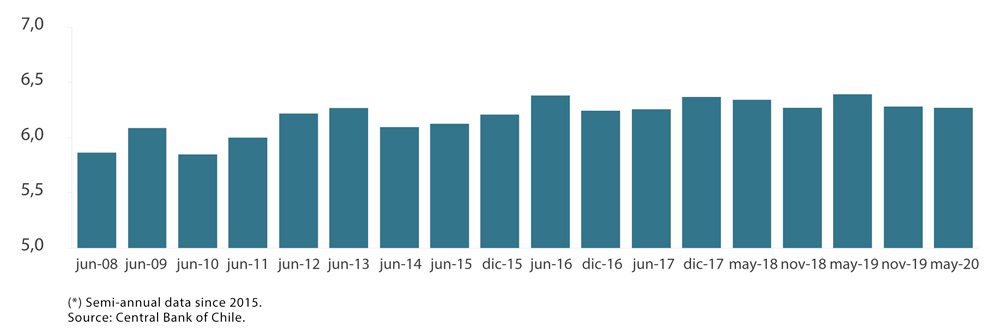

The Financial Stability Report is evaluated through surveys carried out on those attending the different presentations. Respondents rated various aspects of the report using a grade scale of 1 to 7.

FSR general appreciation according to surveys (*)

(average, grade in a scale from 1 to 7)