Encuesta Financiera de Hogares (EFH)

Encuesta Financiera de Hogares (EFH)

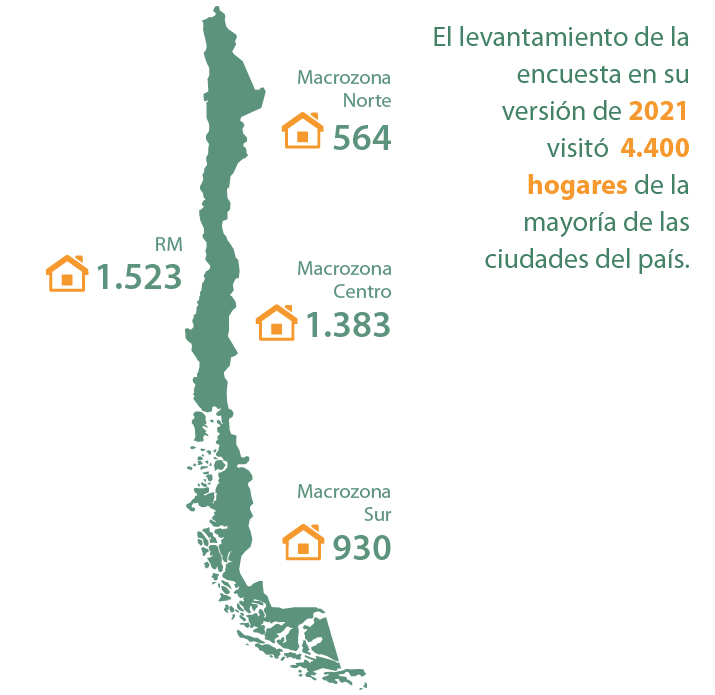

La Encuesta Financiera de Hogares es un estudio que realiza el Banco Central de Chile con el objetivo de generar información detallada de las finanzas de los hogares.

En esta página

-

La Encuesta

-

Principales Resultados 2021

-

Documentos para investigadores

Documentos EFH 2021

Principales Resultados

Documentación

Estudios e investigación

Si tienes alguna investigación para incluir en esta sección, escríbenos a efh@bcentral.cl

(Madeira y Margaretic, 2022) The impact of financial literacy on the quality of self-reported financial information

Autores: Carlos Madeira y Paula Margaretic

Doi: https://doi.org/10.1016/j.jbef.2022.100660

Abstract:

Household finance surveys are now common in many countries. However, the validity of the self-reported financial information is still understudied, especially for complex choices. Using a unique matched dataset between the Chilean Household Finance Survey and the banking system’s loan records, we find a positive effect of financial literacy on the accuracy of loan reporting. These findings are robust to the use of several proxies for financial literacy, such as the OECD INFE measure, the knowledge of the respondent’s personal pension account type, or the use of electronic means of payments. Using a nearest neighbor matching estimator, we confirm that the effect of financial literacy on the accuracy of loan reporting is causal even after controlling for several observable characteristics.

(Madeira et al, 2022) Assessing the Quality of Self-Reported Financial Information

Autores:Carlos Madeira, Paula Margaretic, Felipe Martínez y Pedro Roje

Doi: https://doi.org/10.1093/jssam/smab059

Abstract:

It is well known that self-reported financial information differs from administrative records. This article advances previous studies by using a unique matched representative sample of individual borrowers from the Chilean Household Finance Survey with administrative banking loan records. Our linked dataset allows us to test whether the differences between the two sources are due to the number of nonreported loans or to differences in the reported loan amounts. We show that discrepancies in debt ownership are larger when respondents have a mortgage and are not the highest income member of the family, when respondents have weak financial literacy and do not have confidence in the study, and when respondents live in complex or multigenerational households. However, borrowers report the maturity of their mortgage and installment loans quite accurately. Concerning loan amounts, differences between the two sources decrease with the financial literacy of the respondent. Finally, a simple form of rounding can go a long way towards explaining differences in the middle part of the debt amount and maturity distributions.

(Madeira, 2022) The double impact of deep social unrest and a pandemic: Evidence from Chile

Autores: Carlos Madeira

Doi: https://doi.org/10.1111/caje.12570

Abstract:

This work studies the impact of the Social Explosion and COVID-19 crisis on the household sector in Chile. The Social Explosion in October 2019 represented a mass protest, much larger than similar events in other nations such as the yellow jackets. Using delinquency models calibrated with survey data, I show that household debt risk increased substantially after the Social Explosion across all income backgrounds but fell slightly with the COVID-19 pandemic due to the public policies implemented. The expansion of the public support policies in August 2020 decreased the debt risk to levels similar to before the two crises.

(Delgado et. Al, 2021) Household debt, automatic bill payments and inattention: Theory and evidence

Autores: Carlos Delgado, Jorge Muñoz, Sandra Sepúlveda, Carmen Veloso y Rodrigo Fuentes

Doi: https://doi.org/10.1016/j.joep.2021.102385

Abstract:

In this article we analyze the impact of automatic bill payment (ABP) on household debt. We present a theoretical intertemporal consumption model that shows an inattention effect when individuals subscribe an ABP for their debts. This effect causes a higher level of indebtedness (beyond optimal) and, therefore, well-being loss. Furthermore, we empirically test this theory for Chile, an emerging economy. We estimate a Tobit-Probit conditional mixed process (CMP) model, using data from the Central Bank of Chile’s Household Financial Survey (HFS). The results confirm the existence of a positive and significant effect of the use of ABP on the financial burden of households.

(Madeira, 2021) The potential impact of financial portability measures on mortgage

Autores: Carlos Madeira

Doi: https://doi.org/10.1016/j.jimonfin.2021.102455

Abstract:

This study estimates the potential impact of a recent Financial Portability Law in Chile on the households’ mortgage refinancing probability. I show that mortgage refinancing is positively associated with financial education, liquidity needs, plus the value and timing for optimal refinancing. A counterfactual exercise shows the new legislation can substantially increase the refinancing probability and bring welfare gains, especially if it lowers the cognitive costs of the process. The refinancing probability may increase from 18% to 21.1% and create a welfare gain of 202 USD per borrower if only the pecuniary cost channel of the law is accounted for. However, the refinancing probability and welfare gains may increase to 29.2% and 902 USD, respectively, if the law can also significantly reduce the cognitive-education costs of refinancing. Welfare gains are larger for higher income households and owners of top valued homes. The refinancing gains could also boost the potential impact of monetary policy on consumption.

(Cifuentes et al, 2020) Measuring households' financial vulnerabilities from consumer debt: Evidence from Chile

Autores:Rodrigo Cifuentes, Paula Margaretic y Trinidad Saavedra.

Doi: https://doi.org/10.1016/j.ememar.2020.100677

Abstract:

This paper is concerned with measuring the financial vulnerability (FV) of households arising from consumer debt. Our case of application is Chile. Our main finding is that by applying a methodology that allows for households' heterogeneities and that accounts for contextual factors (like motives for asking for debt, exposure to shocks, family structure, holdings of assets and perspectives of future income), we better quantify the risks that financially vulnerable households may entail to the financial system.

(Cifuentes y Martínez, 2020) Over-indebtedness in Households: Measurement and Determinants

Autores:Rodrigo Cifuentes y Felipe Martínez

Doi: 10.13140/RG.2.2.25420.28805

Abstract:

This paper analyzes the properties of different indicators of over-indebtedness of house- holds. In particular, we compare a group of indicators where one is based on households’ self-assessment and others on financial indicators, with the intent to find the most informative and comprehensive. We then study the determinants of over-indebtedness of households. We use data coming from the 2014 wave of the Survey of Household Finances in Chile. In the first part of the paper, we show that the self-reported measure proves to provide a more comprehensive view of household over-indebtedness than the one obtained from the financial indicators traditionally used for this purpose. In the second part, we estimate a bivariate probit with sample selection to analyze what factors are associated with the over-indebtedness condition. We find that income is an important factor for over-indebtedness, but it does not affect the probability of holding debt. In addition, we show that temporary workers are more prone to over-indebtedness than workers with permanent contracts. Finally, one of the most important results of our paper is that we show that an unexpected shock has a significant effect on both holding debt and reporting being over-indebted. Our results indicate that an appropriate evaluation of the over-indebted condition should consider more than traditionally used financial indicators. We also provide arguments in favor of a comprehensive credit register that would help credit suppliers to better manage credit risks.

(Madeira, 2019) The impact of interest rate ceilings on households’ credit access: Evidence from a 2013 Chilean legislation

Autores: Carlos Madeira

Doi: https://doi.org/10.1016/j.jbankfin.2019.06.011

Abstract:

This study analyzes the impact of a legislation introduced in Chile in 2013, which gradually reduced the maximum legal interest rate for consumer loans from 54% to 36%. Using a representative sample of households that matches survey data and banking loan records, I compare consumers with risk-adjusted interest rates slightly above and slightly below the legal interest rate ceiling, two groups of similar characteristics but who are differently affected by the law. After accounting for both macroeconomic shocks and unobserved household heterogeneity, the results show that being above the interest rate cap reduces the probability of credit access by 8.7% on average. A counterfactual exercise shows that the new legislation excluded 9.7% of the borrowers from banking consumer loans. The law’s impact was strongest on the youngest, least educated and poorest families. Finally, I show that the new law affected all lenders of consumer loans in Chile, not just banks.

(Madeira, 2019) Measuring the covariance risk of consumer debt portfolios

Autores: Carlos Madeira y Paula Margaretic

Doi: https://doi.org/10.1016/j.jedc.2019.05.005

Abstract:

The covariance risk of consumer loans is difficult to measure due to high heterogeneity. Using the Chilean Household Finance Survey I simulate the default conditions of heterogeneous households over distinct macro scenarios. I show that consumer loans have a high covariance beta relative to the stock market and bank assets. Banks’ loan portfolios have very different covariance betas, with some banks being prone to high risk during recessions. High income and older households have lower betas and help diversify banks’ portfolios. Households’ covariance risk increases the probability of being rejected for credit and has a negative impact on loan amounts.

(Madeira, 2018) Explaining the cyclical volatility of consumer debt risk using a heterogeneous agents model: The case of Chile

Autores: Carlos Madeira

Doi: https://doi.org/10.1016/j.jfs.2017.03.005

Abstract:

Previous studies of consumer debt risk estimate low sensitivities to negative shocks, contradicting the historical data. This work proposes a heterogeneous agents model of household finances and credit risk. Families suffer labor income shocks and choose from a menu of loans contracts, defaulting on debt commitments when unable to finance minimum consumption standards. Using a variety of survey data I simulate household credit default for Chile over the last 20 years, replicating successfully the highs and lows of consumer delinquency. Some households are shown to be highly vulnerable to changes in interest rates, credit maturities and liquidity.

(Martínez y Uribe, 2018) Determinants of Household Position within Chilean Wealth Household’s Distribution

Autores: Felipe Martínez y Francisca Uribe

Doi: 10.13140/RG.2.2.26071.11684

Abstract:

This paper analyzes the distribution of net wealth, its relationship with income and the factors that influence the household position within the wealth distribution in Chile. The research draws on microdata from the Survey of Household Finances 2014. We de.ne net wealth as the difference between assets and debts without considering pension wealth. The results show that wealth is unequally distributed among Chilean households. In fact, 73% of wealth is owned by the richest quintile. In addition, we show that to finance partial or totally the main residence with a subsidy has a significant effect on the probability of a household being above the lowest wealth quintile and that inheritances significantly increase the probability of belonging to a higher quintile of wealth. In terms of income we show that, even though it has a significant effect in the wealth position of a household, the relationship between income and wealth is weak.

(Madeira, 2018) Priorización de pago de deudas de consumo en Chile: el caso de bancos y casas comerciales

Autores: Carlos Madeira

Doi: https://repositoriodigital.bcentral.cl/xmlui/handle/20.500.12580/4866

Abstract:

Diversos estudios indican que la deuda de consumo explota debilidades psicológicas de las personas, como errores cognitivos o tentación (Laibson et al., 2000; Kahneman, 2011; Agarwal y Mazumder, 2013). Además, la deuda de consumo es compleja de entender y por eso está asociada a mayores tasas de no pago y morosidad (Alfaro y Gallardo, 2012), sobreendeudamiento y peores niveles de depresión en los deudores (Hojman et al., 2016). Algunos estudios encuentran que la morosidad de la deuda de consumo en la familias chilenas está asociada a riesgos de ingreso, desempleo y elevado endeudamiento del hogar (Madeira, 2014). Sin embargo, estudios anteriores no distinguen la morosidad que las familias tienen con distintos oferentes de crédito de consumo. Este tema tiene particular importancia en Chile, donde más de 60% de las familias tiene alguna deuda de consumo y esta corresponde a un monto casi igual a la deuda hipotecaria (Marinovic et al., 2011). Los bancos y casas comerciales son los principales oferentes de deuda de consumo en Chile (Marinovic et al., 2011), pero actúan con condiciones muy distintas.

(Martínez y Uribe, 2017) Distribución de Riqueza No Previsional de los Hogares Chilenos

Autores: Felipe Martínez y Francisca Uribe

Doi: https://doi.org/10.13140/RG.2.2.36570.44485

Abstract:

Este documento estudia la distribución de riqueza no previsional de los hogares chilenos utilizando la Encuesta Financiera de Hogares 2011-12. La riqueza neta se define como la diferencia entre activos y pasivos, excluyendo el capital mantenido en el fondo de pensión obligatorio. En primer lugar, analizamos la distribución de riqueza y sus características, luego estudiamos la relación entre la riqueza y el ingreso. Por último, estudiamos la distribución de los componentes de la riqueza. Los resultados muestran que el quintil más rico concentra alrededor del 72% de la riqueza y que cerca del 17% de los hogares posee una riqueza negativa. También encontramos que la riqueza muestra una distribución más desigual que el ingreso y que no existe una relación fuerte entre la riqueza y el ingreso. En relación a los componentes de la riqueza, mostramos que la vivienda es el principal activo de los hogares y que la deuda hipotecaria representa el 70% de la deuda total. Finalmente, mostramos que la vivienda principal es el activo mejor distribuido entre los hogares, en contraste a la gran concentración que muestran los activos financieros.

(Ruiz-Tagle y Vella, 2016) Borrowing Constraints and Credit Demand in a Developing Economy

Autores:Jaime Ruiz-Tagle y Francis Vella

Doi: https://doi.org/10.1002/jae.2465

Abstract:

This paper investigates the determinants of credit demand in the presence of borrowing constraints in a developing economy. We model the determinants of observed debt for Chilean households while accounting for selection bias and the endogeneity of their income and specific household assets. Using a novel Chilean dataset, we estimate the relationship between household characteristics and consumer and mortgage debt. We find substantial differences in the nature of these relationships across the types of debt. For example, we find that the income elasticity for consumer debt is greater than 1 whereas for mortgage debt it is not. The results suggest the increased availability of credit, combined with the aging of the Chilean population, is likely to drastically change the distribution and level of Chilean debt. These findings are particularly relevant for other developing economies currently experiencing rapid income and debt growth.

(Madeira, 2014) El impacto del endeudamiento y riesgo de desempleo en la morosidad de las familias chilenas

Autores: Carlos Madeira

Doi: https://repositoriodigital.bcentral.cl/xmlui/handle/20.500.12580/4841

Abstract:

La deuda de las familias es un activo que cada vez cobra mayor importancia en la economía, tanto en Chile como en los otros países en desarrollo (FMI, 2006) y en los países más desarrollados (Girouard et al., 2007). El último Informe de Estabilidad Financiera (2013) muestra que en Chile el crédito bancario hipotecario ha crecido a tasas reales de entre 8 y 16% desde 2006. El crédito bancario de consumo tuvo un crecimiento volátil, dado que aumentó a una tasa real de 20% en 2006-2007, bajó a tasas negativas durante la crisis de 2008-2009, y recuperó tasas reales cercanas al 10% desde 2010 hasta hoy. Este crecimiento en el endeudamiento de las familias tiene implicancias para el sistema financiero, sobre todo en el caso del crédito de consumo cuyo riesgo cíclico es significativo (Alfaro et al., 2011). Para el caso chileno, estudios previos han encontrado que la morosidad de los préstamos de consumo está significativamente asociada a altos niveles de carga financiera y riesgo de desempleo (Martínez et al., 2013), además de bajo ingreso y educación (Alfaro y Gallardo, 2012). Sin embargo, no se ha estudiado cómo cambia el impacto de estos factores de riesgo en el tiempo, lo que es una cuestión de gran importancia, dado que en países como Estados Unidos se ha detectado un aumento significativo en el incumplimiento de las familias a lo largo del tiempo (Gross y Souleles, 2002), hasta aquí sin explicación.

(Martínez et al, 2013) Measurement of household financial risk with the survey of Household Finances

Autores: Carlos Madeira, Felipe Martínez, Rodrigo Poblete y Rubén Poblete-Cazenave

Doi: https://doi.org/10.1016/j.jbef.2022.100660

Abstract:

In this paper we study the determinants of financial risk of households. We estimate the probability of default of household using a probit model with two novel variables: (i) a Modified version of the Debt Service Ratio index (MDSR) and (ii) the probability of job layoff of the head of the household. Our new index allows us to include households without any transitory income in the analysis and solve the outliers' problem underlying the standard Debt Service Ratio (DSR). The probability of layoff allows us to incorporate the uncertainty with respect to the labor status and income of the household's head. In addition, we study the marginal probability of default for different income strata and age strata by levels of MDSR, conditional in others characteristics. We use micro-data from the Survey of Household Finances (SHF) of the Central Bank of Chile. Our estimates show that both, the MDSR and the probability of job layoff, are positively related with the probability of default. In fact, we found a monotonically increasing relationship between the probability of default and the MDSR. Our results allow us to assess the probability of default of the debt outstanding, and to project it under different scenarios.

(Alfaro y Gallardo, 2012) The Determinants of Household Debt Default

Autores:Rodrigo Alfaro y Natalia Gallardo

Doi: 10.4067/S0718-88702012000100003

Abstract:

In this paper, we study household debt default behavior in Chile using survey data. Previous research in this area suggests financial and personal variables help estimate individual and group probabilities of default. We study mortgage and consumer default separately, as the default decisions and overall borrower behavior are different for each type of debt. Our study finds that income and income-related variables are the only significant and robust variables that explain default for both types of debt. Demographic or personal variables are affected by only one type of debt but not more. For example, the level of education is a factor that affects mortgage default, whereas the determinants of consumer debt default include the age of the household head, and the number of people within the household that contribute to the total family income. We find that the probability of default decreases as the family income increases, and that our estimations are consistent with other studies similar to ours.